|

|||

1/19

An overview of FY2018 2Q results has been provided on the first page.

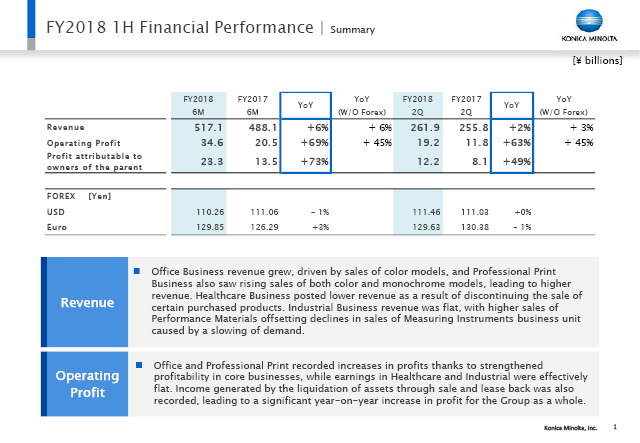

Revenue in the first half of fiscal 2018 came to ¥517.1 billion, an increase of 6% year on year. I will explain the situation by business later on, but as regards revenue, growth in revenue in the Office Business was driven by sales of color models, and Professional Print Business also saw a rise in sales in both color and monochrome models, leading to higher revenues. The Healthcare Business recorded lower revenues as a result of discontinuing sales of certain purchased products, while in the Industrial Business the sales growth in the performance materials business unit offset lower revenue in the measuring instruments business unit, where demand has slowed, resulting in almost flat revenues for the Business as a whole.

In terms of operating profit, Office and Professional Print recorded increases in profits thanks to strengthened profitability in core businesses. Excluding one-off items, Healthcare was almost flat year on year, and Industrial Business also managed to maintain previous-year levels.

Income generated by the liquidation of assets through sale and lease back was added, resulting in operating profit of ¥34.6 billion in the first half, a year-on-year increase of approximately 70%, and equivalent to 56% of the full-year operating profit forecast of ¥62.0 billion. Profit attributable to owners of the parent amounted to ¥23.3 billion, which also constituted significant growth.

2/19

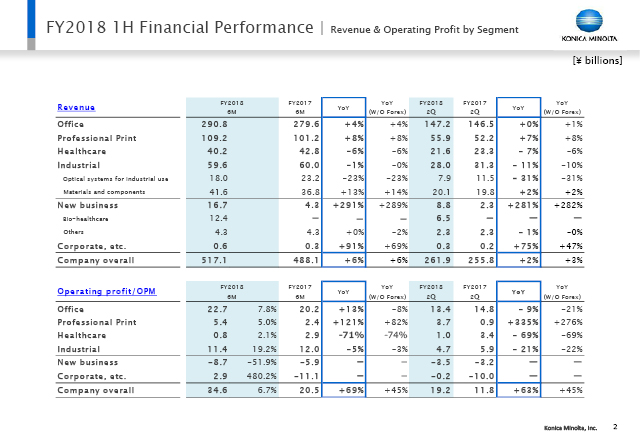

This slide shows revenue and operating profit by segment, but I will explain the details using the next slide, which shows the situation after excluding forex and other special factors.

3/19

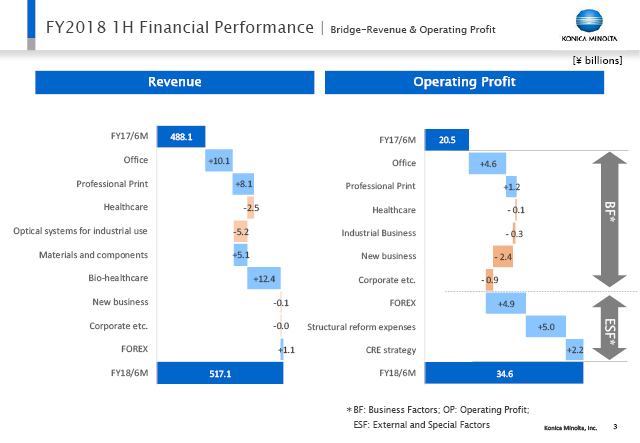

This bridge chart shows revenue and operating profit by segment after excluding the effects of external and special factors such as forex, the liquidation of assets through sale and lease back, and structural reform expenses.

In terms of revenue excluding forex effects, Office and Professional Print also grew, while Healthcare revenue, after being corrected for the effects of discontinuing the sale of certain purchased products, also posted growth, albeit slightly. The field of optical systems for industrial use recorded lower revenue as a result of a cooling of demand in the measuring instruments business unit, but in materials and components, the performance materials business unit and the IJ (inkjet) component business unit posted higher sales, such that the Industrial Business as a whole was more or less flat year on year. In New Business, Bio-healthcare posted revenue growth due to the impact of newly consolidated subsidiaries.

In the same way, operating profit for the Office Business, excluding the effects of external and special factors, rose by ¥4.6 billion in the first half in a continuation of the ¥2.1 billion increase posted in 1Q. Professional Print posted a profit decline of ¥0.3 billion in 1Q, but this was followed by a further strengthening of profitability in the core business of production print, and margins in industrial printing also improved, resulting in a profit increase for the first half of ¥1.2 billion. The Healthcare Business and Industrial Business were both in line with the previous year, so core and growth businesses together achieved a ¥5.4 billion increase in profits.

Although New Businesses saw costs rise year on year to cover investments for the launch of Workplace Hub, and for the expansion of the Bio-healthcare business, these upfront investments were in line with forecasts.

The structural reform expenses of ¥5.0 billion and the CRE expenses of ¥2.2 billion will be explained on the next slide.

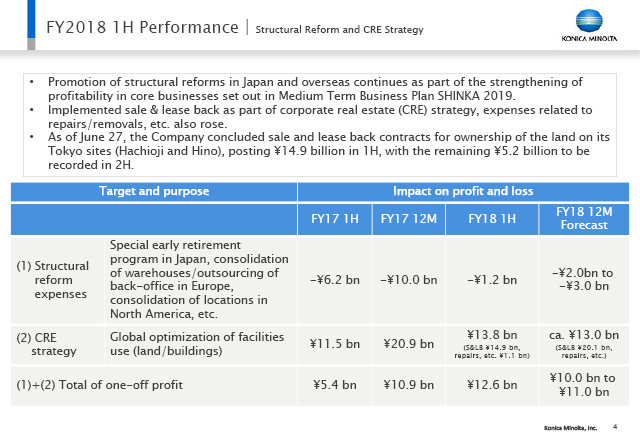

4/19

In the first half, about ¥1.2 billion of the ¥2.0 billion to ¥3.0 billion of structural reform expenses forecast for the full year was recorded, mainly in Europe. In the same period of the previous fiscal year about ¥6.2 billion was posted mainly for Japan, and that portion will result in improvements of around ¥5.0 billion this fiscal year.

As for the CRE strategy, of the ¥20.1 billion in gains for the year generated by sale and lease back contracts concluded by the Company for ownership of the land of the Company’s Tokyo sites (Hachioji and Hino), ¥14.9 billion was posted in 1H. In addition, of the ¥7.0 billion or so in expenses related to repair/removals, etc. estimated for the year, ¥1.1 billion was posted in the first half, so the net figure was ¥13.8 billion. In the same period of the previous year approximately ¥11.5 billion was recorded, so this portion has generated around ¥2.2 billion in profit increases.

There has been no change to forecasts for the fiscal year as a whole.

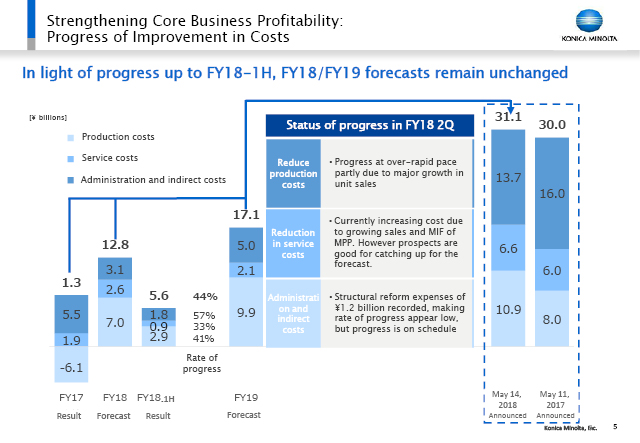

5/19

With regard to the initiatives for cutting production, service, and administration & indirect costs as part of the strengthening of core business profitability, there is some variation in different areas, but the total came to ¥5.6 billion in the first half. This progress is equivalent to 44% of the total ¥12.8 billion estimated for the full year, which is in line with forecasts.

In the case of production costs, partly due to significant growth in unit sales, progress is ahead of schedule at 57% of the full-year estimate.

With regard to service costs, material costs increased due to sales of MPP color products and the resulting growth in MIF, resulting in slow progress in 1Q that we were unable to compensate for completely in 2Q. Progress against the full-year figure of 33% may appear low, but we expect to catch up over the course of the year.

Administration & indirect costs, after netting off against the structural reform expenses of ¥1.2 billion, achieved 41% of the full-year estimate. This progress was in line with expectations.

6/19

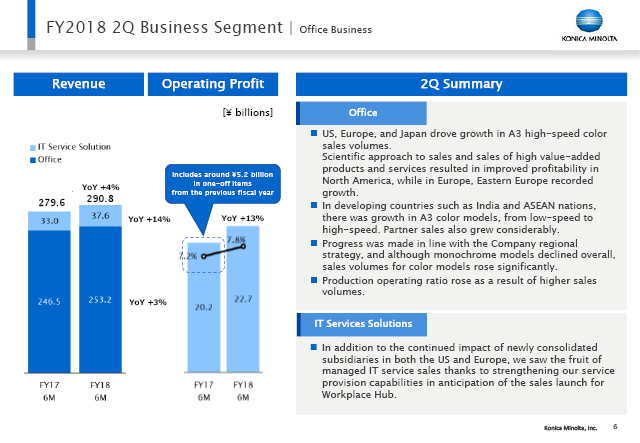

I will summarize each business in turn.

First, in the office products business unit, in line with the goals of the Company’s regional strategy, sales of high-speed A3 color MFP products in Japan, the US, and Europe expanded, and profitability improved due to a more scientific approach to sales and as a result of sales of high value-added products in North America. In Europe sales growth was particularly strong in Eastern Europe.

In developing countries such as ASEAN nations and India, sales of color models increased significantly in all speed segments, and sales through our partner channels also rose considerably.

In addition, due to the higher production operating ratio resulting from the growth in sales volumes, we succeeded in reducing production costs.

In IT service solutions, in addition to the impact of newly consolidated subsidiaries acquired in the US and Europe during the second half of the previous period, we strengthened our managed IT service sales and service provision capabilities in anticipation of the sales launch for Workplace Hub, and saw higher sales and revenue for these services as a result.

As a result of the above, revenue for this business segment in the first half came in at ¥290.8 billion, while operating profit was ¥22.7 billion, up 13% year on year.

Moreover, the roughly ¥5.2 billion in one-off items from the previous fiscal year shown in the bar chart refers to gains from sale and lease back, the stripping out of which reveals an effective increase in profit of ¥7.7 billion, equivalent to growth of +51%.

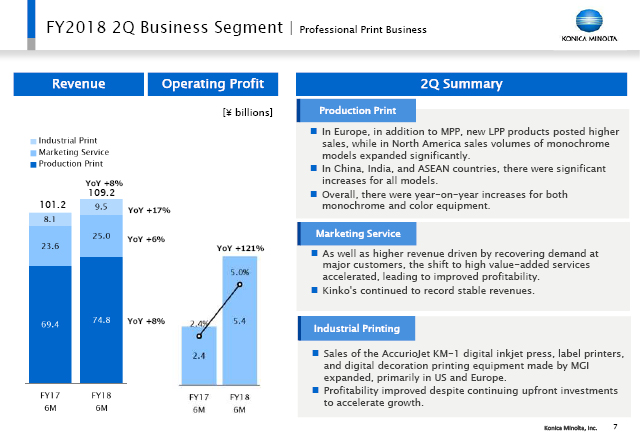

7/19

In the production print business unit, which is one of our core businesses, the top-of-the-line AccurioPress C6100 series continued to drive sales of MPP, in addition to which the new AccurioPress C3080 LPP product that was launched in 1Q also saw sales expand. North America recorded significant growth due to factors such as the ongoing adoption of monochrome models in solutions provided to universities.

Developing countries such as China, India, and ASEAN nations posted considerable growth in sales volumes of both color and monochrome models.

As a result, both color and monochrome models grew overall.

In the marketing services business unit, not only did demand from major customers recover, but the shift to high-margin, high value-added services also accelerated, leading to continued improvements in profitability.

In the industrial printing business unit, sales of value-added products such as the AccurioJet KM-1, label printing equipment, and digital decoration printing equipment continued to expand in the US and Europe. We continue to invest actively in this area by adding highly specialized resources and so on, despite which margins improved from 1Q due to the increase in gross profit resulting from quarterly growth in the top line.

As a result of the above, revenue for this business segment in the first half came in at ¥109.2 billion, while operating profit hit ¥5.4 billion, up 121% year on year.

8/19

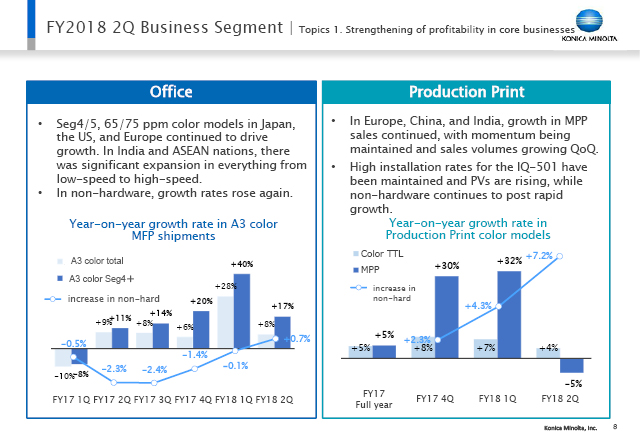

Now I will use these charts to explain the strengthening of profitability in core businesses.

These show growth in sales of color models and in non-hardware revenue in the office products business unit and the production print business unit. In the office products, sales of the color Seg4/5 that account for more than half of non-hardware have continued to grow in Japan, the US, and Europe, while in India, ASEAN, and other developing countries, there has been significant expansion in all models from low-speed to high-speed. In the quarter under review, sales of A3 color models rose by 8%, while that of Seg4/5 was 17%, which has slowed from the previous quarter, but this is because this expansion began in the same period of the previous fiscal year, meaning that there has been sustained growth. As a result, non-hardware revenue moved into positive territory in the quarter under review, as expected, and for the full year we forecast year-on-year growth of 1%.

In the production print, the AccurioPress 6100 series has driven growth in sales of MPP in Europe and India. Due to the effects of growth in sales volumes during the same period of the previous fiscal year, caused by factors such as the selling off older models, there was a decline of 5% year on year, but the average selling price is improving, and sales volumes are increasing every quarter, showing that momentum has been maintained. On a volume basis, there was an increase of 19% from 1Q to 2Q.

The high installation rates for the IQ-501 have continued, and the significant growth in non-hardware has also been sustained. This is also one of the drivers of the improvement in profitability in Professional Print.

9/19

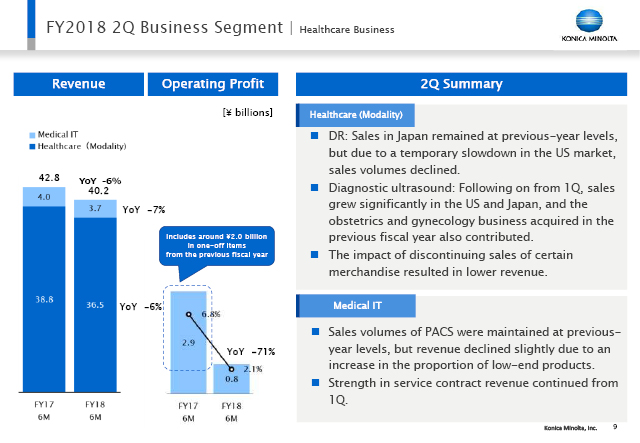

Total revenue for the Healthcare Business was ¥40.2 billion, a decline of 6% year on year, but as I pointed out in 1Q, we discontinued sales of low-margin purchased products, and if the impact of those sales is taken into account, revenues actually increased slightly year on year. In terms of the breakdown, the healthcare (modality) business unit revenue was ¥36.5 billion, declining 6% year on year, while the medical IT business unit posted revenue of ¥3.7 billion, declining 7% year on year. Operating profit was ¥0.8 billion, but if the one-off items of around ¥2.0 billion (related to sale and lease back) posted in the same quarter of the previous fiscal year are subtracted from the ¥2.9 billion recorded in that quarter, operating profit was more or less flat.

In the healthcare (modality) in 2Q, DR was flat year on year in Japan, but there was a temporary slowdown in the US market, causing sales volumes to decline. Following on from 1Q, diagnostic ultrasound systems remained strong, recording significant sales growth in Japan and the US. In Japan, the obstetrics and gynecology business acquired from Siemens Healthcare in the previous fiscal year also made a considerable contribution to sales.

In the medical IT, low-end products increased as a proportion of sales in Japan, and although service contract revenue remained strong, revenues declined slightly.

10/19

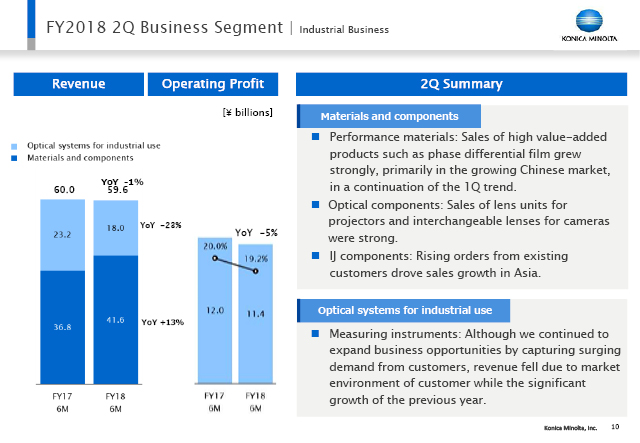

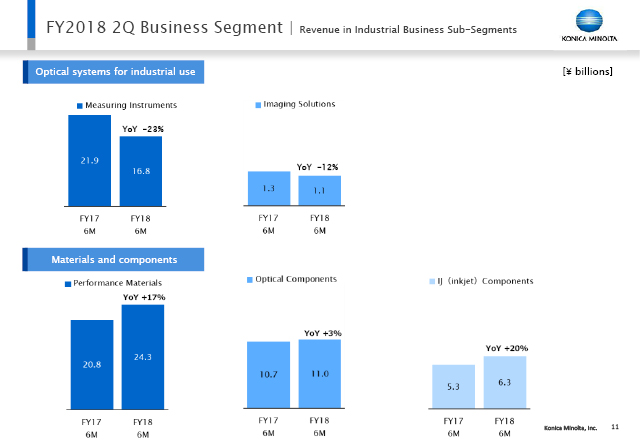

In the Industrial Business, total revenues were about flat year on year at ¥59.6 billion. Broken down further, the materials and components field had a good quarter, posting revenues of ¥41.6 billion, up 13% year on year, but optical systems for industrial use field declined 23% year on year to ¥18.0 billion. Operating profit for the Industrial Business as a whole declined 5% year on year to ¥11.4 billion.

In the materials and components field, the strategy of shifting to high value-added products, such as new water-resistant VA-TAC films for large LCD TVs and ZeroTAC films for IPS panels bore fruit in the performance materials unit, and business was strong. In the optical component unit, there was growth in sales of lens units for projectors and interchangeable lenses for cameras. The IJ (inkjet) component unit put in a strong performance, centered on sales in China of printheads for UV ink equipment.

In the field of optical systems for industrial use, there was a temporary slowdown in the display-related demand that drove significant growth in revenues in the measuring instruments business unit last fiscal year, and revenues fell accordingly. Nevertheless, we expect the trend of conversion to OLED to continue, and believe that there will be further growth in business opportunities going forward.

11/19

On this slide we show the year-on-year change in the first half for each business units of the Industrial Business that we just discussed.

12/19

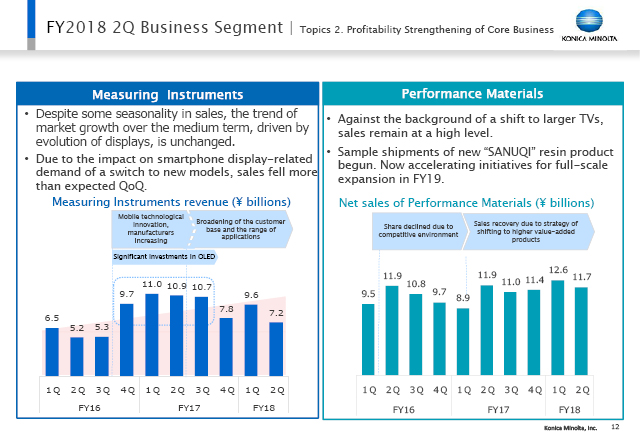

Now we will take a closer look at the measuring instruments and performance materials business units from the Industrial Business.

The display-related capital investments made by major customers, which drove significant growth in measuring instruments sales last fiscal year, began a temporary slowdown in FY2017 3Q, but in addition to the following wind of technological innovation in mobile devices, our strategy of expanding our customer base has borne fruit, and the level of quarterly sales has risen. Display applications other than smartphones and tablets are on the increase, and we expect to see further growth in business opportunities.

Performance materials bottomed in FY2017 1Q, and our sales strategy of focusing on high value-added products to take advantage of the background shift to larger TVs, such as new water-resistant phase differential film, has proven effective, leading to a sustained high level of revenues. Sample shipments of the new “SANUQI” resin product have begun, and we are preparing for full-scale expansion in FY2019.

13/19

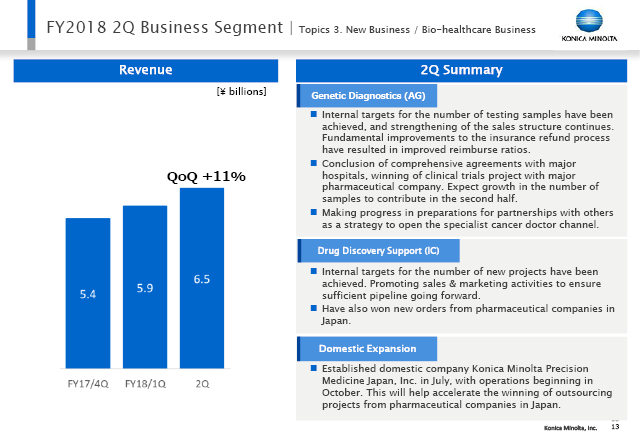

Now we will move on to discuss the progress made in Bio-healthcare, one of the new businesses.

This recorded revenue of ¥6.5 billion in the quarter under review, continuing the trend of sequential growth from the previous quarter.

In the genetic diagnostics services, we have achieved our internal target for the number of testing samples, and the fundamental improvements we have made to the insurance reimburse process have resulted in improved reimbursement ratios, which are visible in the form of higher sales. In terms of measures to broaden our sales channels, in the second half we expect to see the effects of both the increase in samples won from a major hospital group, and growth in samples related to the clinical trials project agreed with a major pharmaceutical company in the previous quarter. In addition, we are making progress in our preparations for specific partnerships with others as part of our strategy to open the specialist cancer doctor channel.

In the drug discovery support services, the value of the current pipeline has exceeded the amount set in the yearly plan, and we continue to expand the pipeline. We have also won new orders from a Japanese pharmaceutical company.

This was the subject of a press release on September 26, and it was also discussed at the “Management policies briefing session” held on September 27, but we established Konica Minolta Precision Medicine Japan, Inc. to facilitate our business expansion in Japan, and that company began operations this month. This accelerates our activities in Japan and helps win outsourcing projects from domestic pharmaceutical companies.

14/19

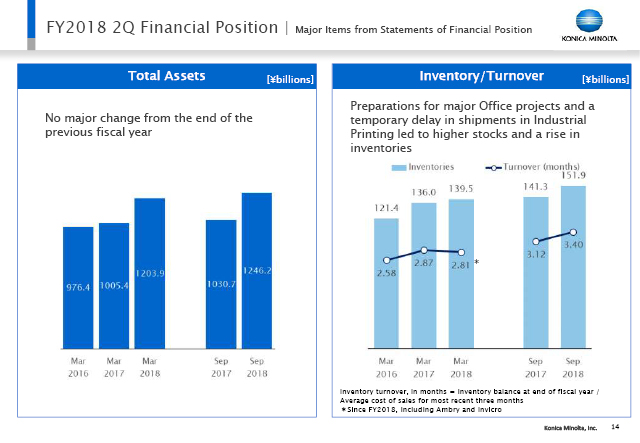

Now let us turn to the financial position of the Group. There has been no major change in total assets from the end of the previous fiscal year. Inventories have risen slightly, but this is the result of inventory being built up for a major project scheduled for installation in 3Q, as well as higher inventories for Industrial Printing in growth businesses where sales volumes are expanding rapidly. We expect inventories to normalize in 3Q.

15/19

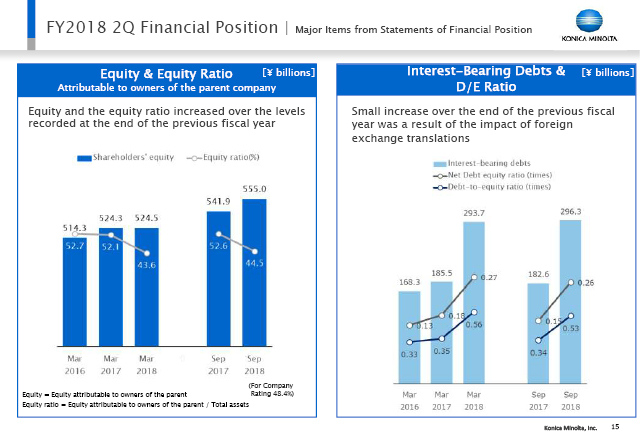

Both equity and the equity ratio have increased from the levels recorded at the end of the previous fiscal year, as a result of higher profits.

Interest-bearing debts have increased from the end of the previous fiscal year, but this is a result of the effects of foreign exchange translations.

16/19

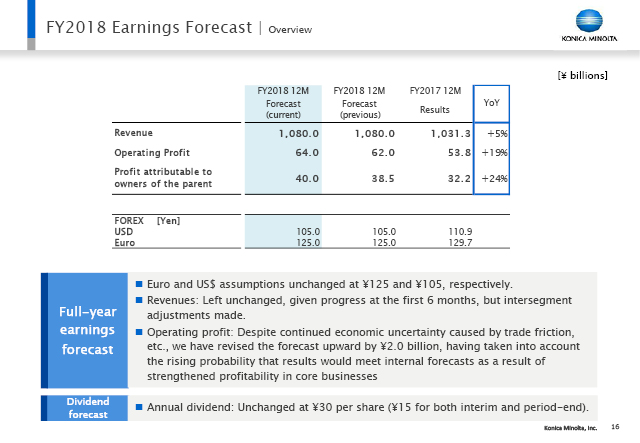

Finally I will touch upon the earnings forecasts for the full year.

With regard to the foreign exchange rate, taking into account the market’s risk-averse stance caused by issues such as the trade friction between the US and China, and other economic uncertainties looking forward, we have left our assumptions unchanged at ¥125 to the euro and ¥105 to the US$.

Having made adjustments for the strengths and weaknesses in the various businesses, we have left revenue for the Group as a whole unchanged at ¥1,080.0 billion.

As for operating profit, the effects of strengthened profitability have been visible throughout the first half in the shape of improved gross margins, resulting from sales of high value-added productions and reductions in costs, as well as lower SG&A expenses. Taking into account the steady progress of results towards internal plan, we have made an upward revision to operating profit. Based on our unchanged forex assumptions and our consideration of the risks stemming from economic uncertainties such as trade friction, we have increased the Group operating profit forecast by ¥2.0 billion.

There has been no change to the dividend forecast.

17/19

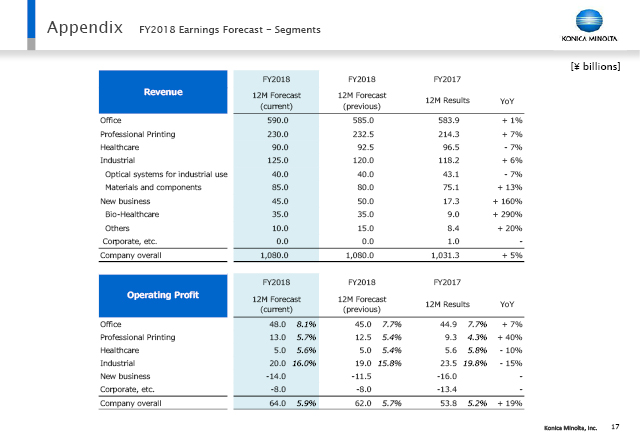

This slide shows the revised earnings forecasts by segment.

In terms of operating profit, we have increased the forecasts for the Office, Professional Print and Industrial Businesses, which performed strongly relative to internal plan through the first half. In New Business, we have made revisions to the figures to reflect delays of slightly more than one month (to September) in the sales launch of the Workplace Hub, and have taken a conservative view of the risk that earnings at the end of the year will slip into FY2019.

18/19

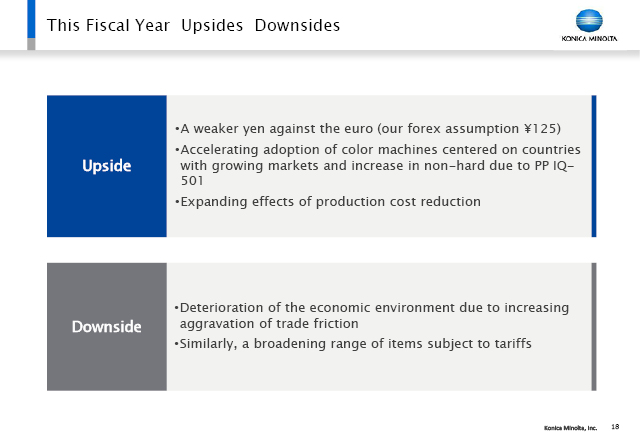

This slide presents the upsides and downsides of our forecasts for the full year.

The upsides are a weaker yen against the euro; an acceleration in the adoption of color machines, primarily in developing countries; increases in non-hardware driven by the IQ-501; expanded effects from reductions in production costs.

On the other hand, downsides include deterioration in the economic environment due to intensifying trade friction, and a broadening of the number of items subject to tariffs.

19/19

First, in the office products business unit, in line with the goals of the Company’s regional strategy, sales of high-speed A3 color MFP products in Japan, the US, and Europe expanded, and profitability improved due to a more scientific approach to sales and as a result of sales of high value-added products in North America. In Europe sales growth was particularly strong in Eastern Europe.

In developing countries such as ASEAN nations and India, sales of color models increased significantly in all speed segments, and sales through our partner channels also rose considerably.

In addition, due to the higher production operating ratio resulting from the growth in sales volumes, we succeeded in reducing production costs.

In IT service solutions, in addition to the impact of newly consolidated subsidiaries acquired in the US and Europe during the second half of the previous period, we strengthened our managed IT service sales and service provision capabilities in anticipation of the sales launch for Workplace Hub, and saw higher sales and revenue for these services as a result.

As a result of the above, revenue for this business segment in the first half came in at ¥290.8 billion, while operating profit was ¥22.7 billion, up 13% year on year.

Moreover, the roughly ¥5.2 billion in one-off items from the previous fiscal year shown in the bar chart refers to gains from sale and lease back, the stripping out of which reveals an effective increase in profit of ¥7.7 billion, equivalent to growth of +51%.