|

|||

1/26

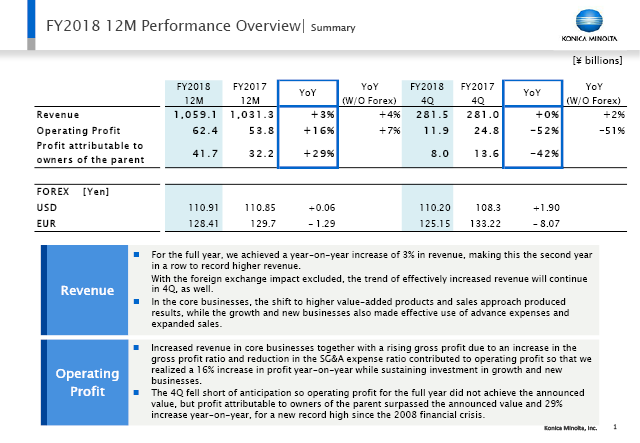

At first, I’ll mention the summary of the full-year financial performance.

The revenue increased by 3% year on year, and the revenue in 4Q also increased by 2% in real basis excluding foreign exchange rates. The shift to high value-added sales in core business achieved an outcome, and sales in growth and new businesses were added.

The operating profit rose by 16% year on year, driven by core business, despite the continued investment in growth and new businesses. However, we didn’t achieve the full-year forecast, which was raised to ¥64.0 billion, and we took the situation seriously.

The profit attributable to owners of the company increased by 29% and reached to ¥41.7 billion, surpassing financial forecast and posting record-high profit after the global financial crisis.

2/26

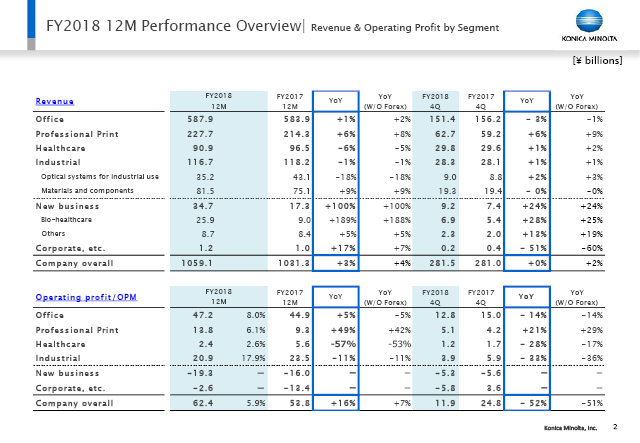

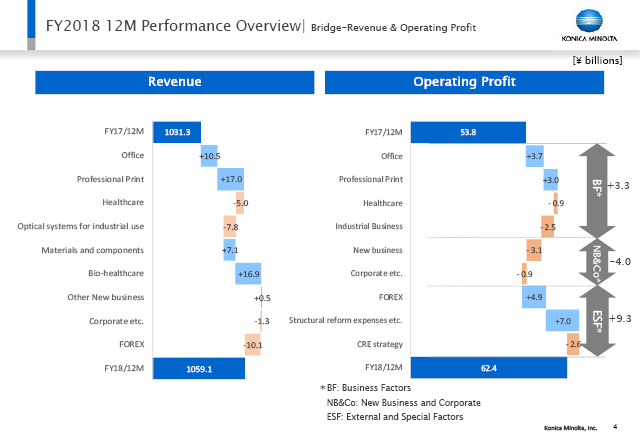

This slide contains the revenue and the operating profit by segment.

I will explain the specific factors, and then explain the cause of increases and decreases on a real basis excluding the foreign exchange rate.

3/26

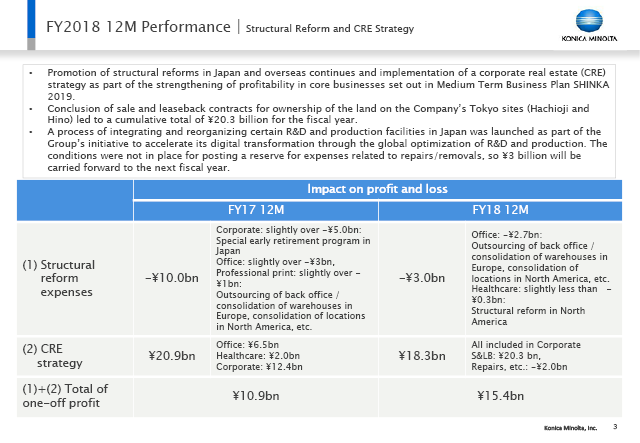

This slide details the expense in the structural reform and the effect of CRE strategy.

In structural reform, we reduced the expense by ¥7.0 billion year on year in FY2018.

Regarding CRE strategy, the total of ¥20.9 billion benefit in FY2017 was divided into not only Corporate but also the Businesses. In FY2018, CRE continued to achieve benefit of ¥20.3 billion, but on the other hand, an expense of ¥2.0 billion in repair and removal costs was spent. As the result, it decreased ¥2.6 billion from the previous fiscal year. ¥3.0 billion for the repair and removal costs is carried over to FY2019 due to delays of the construction because of the construction rush and delay of the negotiations.

4/26

This slide analyzes the increases and decreases in each business.

Office Business and Professional Print Business, the core business of the Company, drove growth in revenues and profits on a real basis excluding foreign exchange rates. The substantial increase in the revenue in Office Business was ¥10.5 billion, the increase in the operating profit was ¥3.7 billion. This was attributable to the shift to high value-added businesses, the reduction of the production costs, the reduction of the service costs, and the reduction of SG&A. Revenue in Professional Print Business increased by 8% year on year, and reached to 17.0 billion, contributing to our higher profit. The profit in Professional Print Business increased by ¥3.0 billion, even though it has made prior investment in the industrial printing unit, which is a growth business. In production print business unit, the substantial operating profit ratio exceeded 10%, and it will continue to contribute to the enhancement of core businesses in FY2019.

5/26

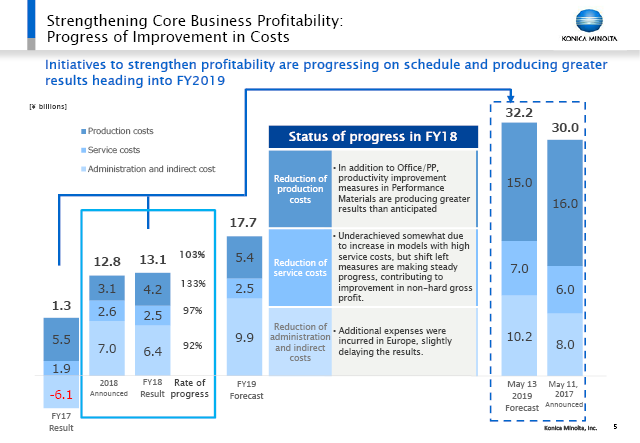

We announced ¥30 billion cost reduction in the Medium Term Business Plan. The initiatives are progressing on schedule as shown in this slide.

FY18 result shows ¥4.2 billion reduction of production costs, in which ¥2.3 billion was related to Office Business. Reduction of ¥2.5 billion service costs also mainly contributed to Office Business and Professional Print Business, which led to an increase in non-hard gross profit of Office Businesses.

The forecast of FY2019 is ¥17.7 billion, and the total in the three-years Medium Term Business Plan will be ¥32.2 billion.

6/26

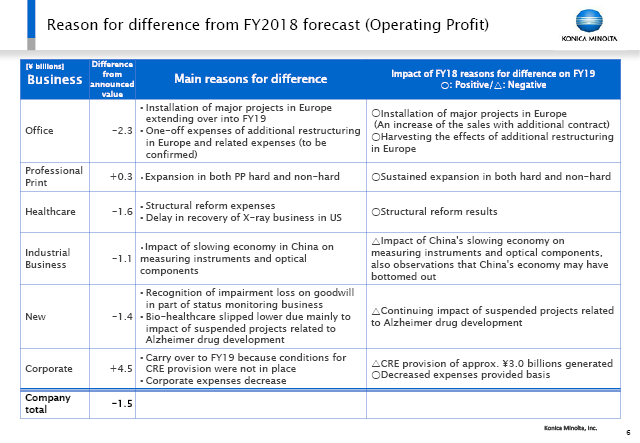

This section details the variance of approximately ¥1.5 billion compared to the ¥64.0 billion in the operating profit announced as the financial forecast for FY2018.

One of the major factors was the delay of installation of large-scale projects (nearly 10,000 units) in Office Business in Europe, which is postponed to FY2019.

In Healthcare Business, we were unable to predict the slump in the U.S. hospitals market, and the number of installed DRs declined from the previous year. As a result, we began structural reform in the U.S. In Industrial Business, measuring instruments and optical component were affected by the slowing economy in China related to smartphones and other products.

In New Businesses, we strongly felt that the values we provided to our customers were well accepted. However, in 4Q, we recognized impairment losses equivalent to 4% of MOBOTIX's goodwill in the status monitoring business. Invicro in the bio-healthcare business was affected by the canceled project related to Alzheimer drug development in the pharmaceutical company.

7/26

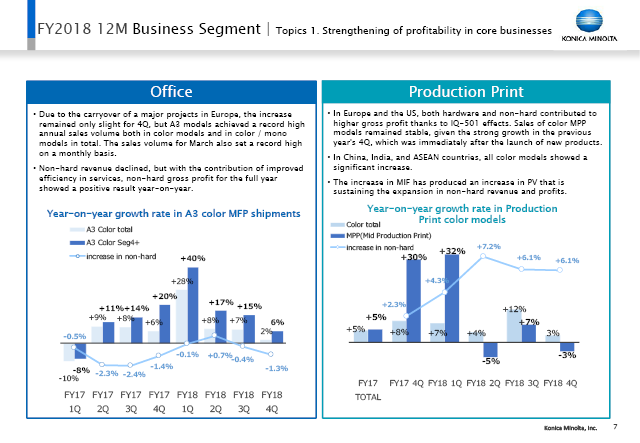

Let me explain more about Office Business and Production Print Business.

A3 color MFPs posted 9.8% increase in annual unit sales despite of the carryover of a major project to FY2019 in Europe. The market growth was 4.5%. The non-hard revenue declined compared to the previous fiscal year since the second half of FY2018, but the gross profit has increased because of the improved efficiency in services as I mentioned earlier.

In Professional Print Business, 4Q's year-on-year growth is based on the premise that there had been a large-scale launch of new products in the previous year's 4Q. In the mid production print, where we are focusing our efforts, unit sales grew by 4% compared to 2% in the market for the full fiscal year. As a result, non-hard revenue has increased by more than 6%. The effects of IQ-501 in addition to improving and automating work flows, which are not available by competitors, contributed a positive impact on both hardware and PV. We will also continue to promote these initiatives in FY2019.

8/26

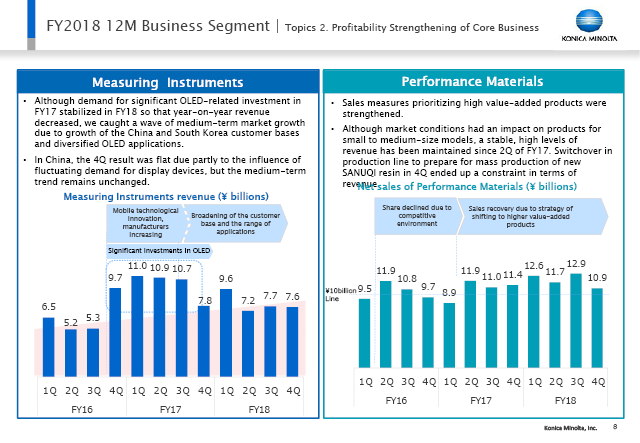

The graph on the left side shows the variance of the revenue in measuring instruments from FY2016. Although demand for significant OLED-related investment stabilized, the trend of sustainable growth has been maintained due to the spread of the customer base to China and South Korea and the diversified OLED applications. In 4Q, the Chinese economy had a slight impact on smartphones.

In performance materials, we have shifted our focus to high value-added strategy since the 2Q of FY2017, and we have been able to grow both the revenue and the profits continuously. In 4Q, we stopped the production line to switch to new resin, but we have completed preparations for FY2019.

9/26

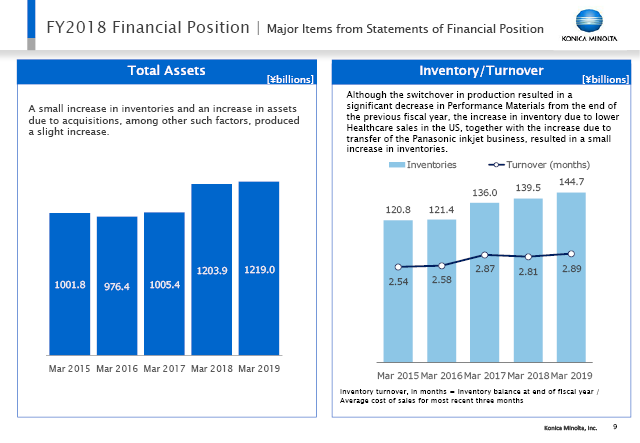

The balance sheet includes asset increases from acquisitions. The inventory and the turnover are shown.

This increase was attributable to the increase in the inventories of Healthcare Business in the U.S. and the increase in the asset of inkjet business acquired from Panasonic. Since FY2019, we will strengthen our control.

10/26

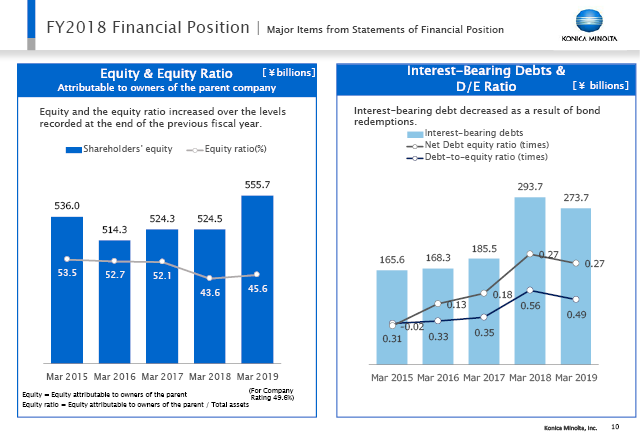

The equity ratio will be close to the target of 50%. The interest-bearing debts were reduced by the repayment of bond by approximately 20 billion yen.

11/26

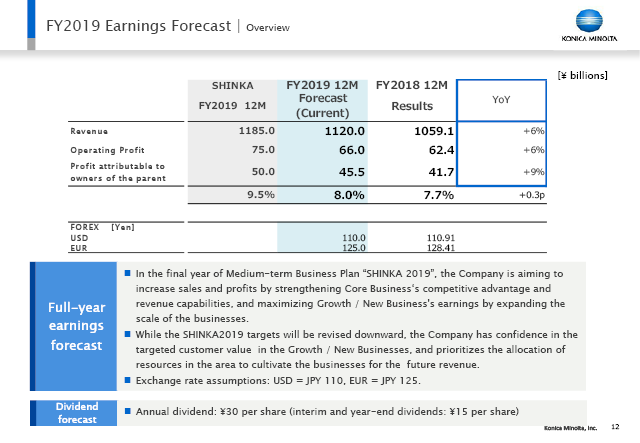

From here on, I will explain our financial performance forecast in FY2019.

12/26

We estimate our financial forecasts in FY2019 as the revenue is ¥1,120.0 billion, 6% increase from the previous fiscal year, the operating profit is ¥66.0 billion, 6% increase, the profit is ¥45.5 billion, 9% increase, and ROE is 8.0%. The exchange rate is ¥110 to the U.S. dollar and ¥125 to the euro, approximately ¥5 of strong yen from the previous fiscal year under considering the prevailing exchange rate.

Although we have not reached the revenue and the operating profit indicated as the management target in the final year of our Medium Term Business Plan “SHINKA 2019”, we will steadily implement further expansion in profits in FY 2019 with corresponding to the strong performance of core businesses in FY2018. While the growth and new businesses are around a year behind from the original plan, we are gaining supportive responses to our value provision from our customers. Rather than shrinking the resource for increasing sales, in FY2019, we will establish the pillar for our high value-added business for the future.

Foreign exchange rates are based on the assumptions I mentioned earlier. We plan to pay dividends of ¥30 per share annually.

13/26

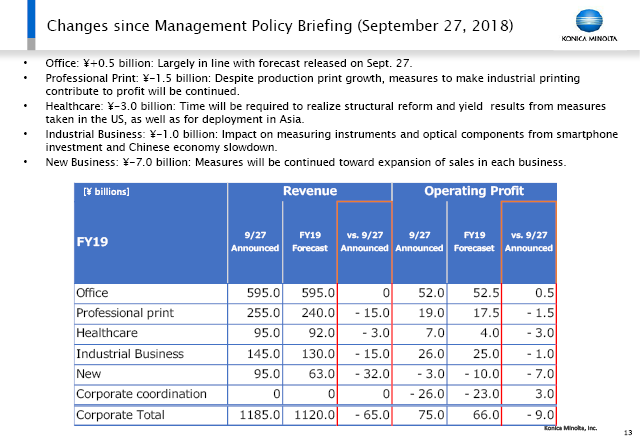

At the management policies briefing session held in the last September, I stated that the operating profit in FY2019 would be aimed at reaching ¥75.0 billion as originally targeted. In this slide, the deviations from the meeting is shown in each business.

In the Professional Print Business, although we feel that we are still in the strong market environment by the figures as ones of the last September in the production printing unit, there is a divergence of ¥1.5 billion due to the investments required in industrial printing units.

Healthcare was based on the profit level in FY2018.

The deviation of ¥1.0 billion in the Industrial Business is based on the assumption that the impact of the Chinese economy from the second half of FY2018 will remain somewhat in the first half of FY2019, and we will pay close attention toward the second half.

In new businesses, although we are gaining supportive responses, we struggled to satisfy the needed resources and it caused the one-year delay, which led to the gap from the target.

14/26

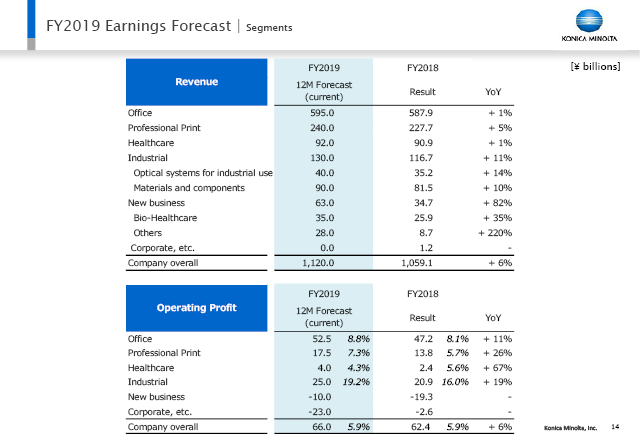

Specific figures are provided by each business segment.

I’ll explain the main initiatives to achieve increases in both revenues and profits in all segments using the following slide.

15/26

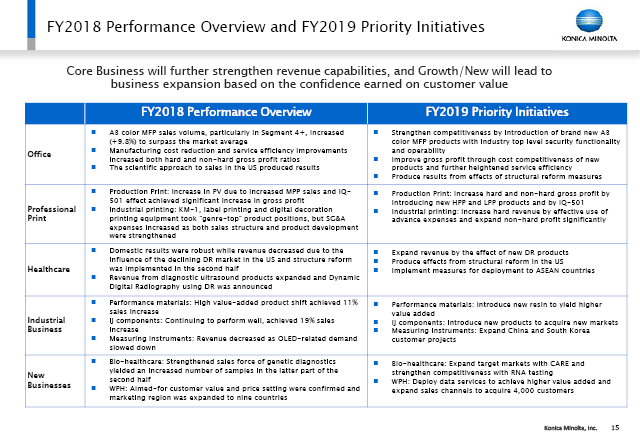

This slide provides a summary of FY2018 and highlights of main initiatives for FY2019 in each business.

In Professional Print Business, although we currently hold the top market share in the MPP, we will launch new products in HPP for the first time.

In Healthcare Business, where the U.S. market is struggling, we will further strengthen cost competitiveness with new DR products. We conduct an activity to differentiate our technology by Dynamic Digital Radiography, which has been highly renowned in Japan.

In Industrial Business, in performance materials unit, we will make a full-fledged effort to expand the range of applications on top of polarizing plates using new resins other than TAC. The IJ(inkjet) component unit has been a remarkably profitable business, furthermore we will introduce new MEMS printheads, used in such as large-format UV and water-based Textiles, to expand the business.

As the additional information, even though we don’t mention it in the slide, regarding the balance of the revenue between the first and second half of FY2019, we weigh the revenue and profit in the second half than in the first because we expect the effects of new products in core businesses and the contributions in revenue from growth and new businesses in the second half of the fiscal year.

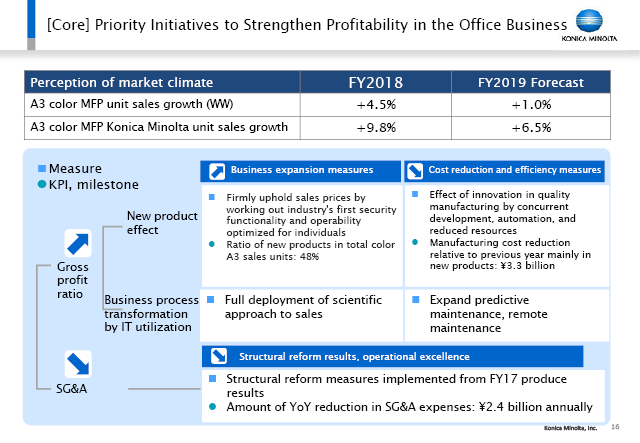

16/26

I will introduce the KPIs for Office Business and Professional Print Businesses in following two slides, respectively.

The growth rate of the color A3 MFP market is expected to be severe as 1% in FY2019, compared with 4.5% in FY2018. However, we assume our company will achieve 6.5% growth rate in the unit sales. We will reach the ratio of new products to 48% of the total, nearly half of the unit sales in FY2019. New products are already being mass-produced in Malaysia, and we will maintain and strengthen the prices of these products while reducing production costs by ¥3.3 billion annually. In other words, we will not sell them at lower price by increasing added value, sparing the reduced production cost ¥3.3 billion as our profit. We deploy successful scientific approach to sales conducted in the United States to other regions to achieve it. This is an initiative by which we maximize the profit by thoroughly focusing on additional value productivity per employee with scientifically analyzing the field or the types of our customers. We assume that SG&A expenses will be reduced by ¥2.4 billion by the effect of structural reform.

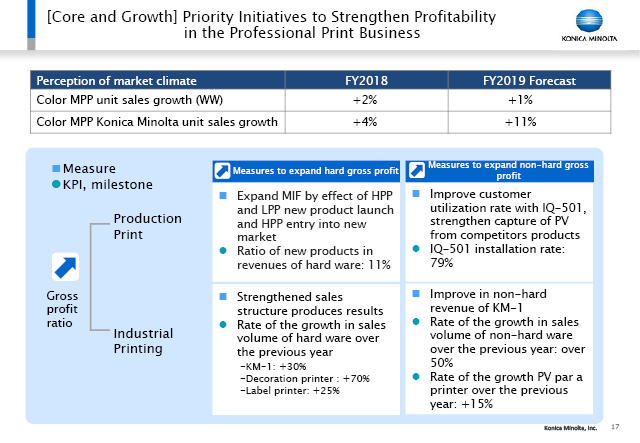

17/26

In Professional Print, the market growth in the color MPP unit sales is assumed to be 1%, while we expect our growth to be 11%. In the revenue of the hardware, the ratio of new products is 11%. This is not a replacement of our machines, but we strengthen to capture PVs from competitors by installing IQ-501 in 79% of machines sold.

In industrial printing, KM-1 is currently positioned at the second largest market share, and we are aiming for more than 30% growth in unit sales. The digital decoration printing market, which is mainly MGI products and currently achieve the largest market share though it’s niche market, is expanding by 70%. And label printers will be expanded by 25%, which are already genre-top in the mid-range market. Along with the growth in the unit sales, the non-hard is also expanding. Although the actual contributions to the profits will begin in FY2020, but we will continue to make steady progress in FY2019.

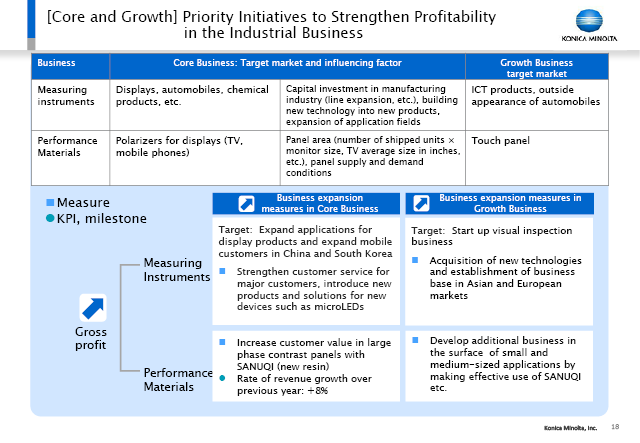

18/26

I’ll explain the main initiatives in Industrial Business.

Micro-LEDs have gathered attention recently, and it is expected that televisions using micro-LEDs will spread in FY2020. To take advantage of the trend, we will introduce new products for light sources measurement equipment for micro-LEDs in FY2019 in measuring instruments with aiming a genre-top position. In addition, we will launch an automotive visual surface inspection business in FY2019 to grow the business as one of the pillars for our revenue from FY2020.

In performance materials, sales are expected to increase by 8% based on the increase in customer value by new resins.

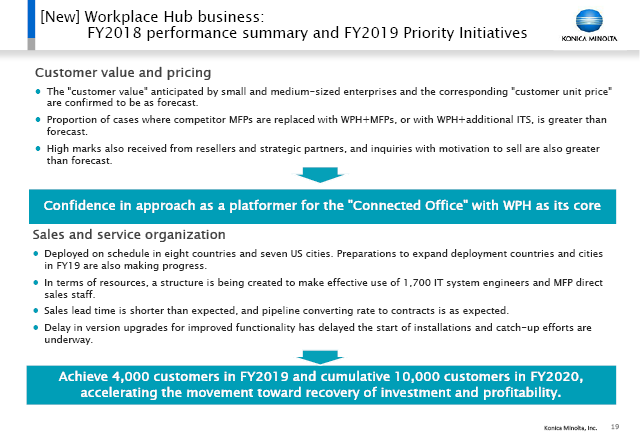

19/26

I’ll introduce Workplace Hub and bio-healthcare as the initiatives in new businesses.

First, Workplace Hub was launched in FY2018, but there was a delay due to upgrades to improve the function. As a result, the substantial installation launched in 4Q. However, the customer value and the corresponding customer unit price have been achieved as we expected by the contracts signed by customers in small and medium-sized companies. In addition to Workplace Hub, several MFPs have been replaced from competitor's products, and there are cases in which Workplace Hub and the IT services have been combined in the contract. The ratio of these cases is higher than our expectation, and we feel the considerable response. The Workplace Hub is highly praised by our strategic partners, and as a platform of Connected Office, we are aiming to achieve a total of 10,000 customers in FY2020, which is the breakeven point, and to achieve 4,000 customers as KPI in FY2019.

The deployment countries and the service organization are described here. We fully leverage the IT service expertise in the U.S. and Europe, which we have acquired through M&As, and 1,700 IT system engineers. At the same time, we have felt the considerable response that we are able to combine multiple MFPs with Workplace Hub. With considering these points, we will move forward the transition from direct sales of MFPs, which is our strength, to Workplace Hub.

20/26

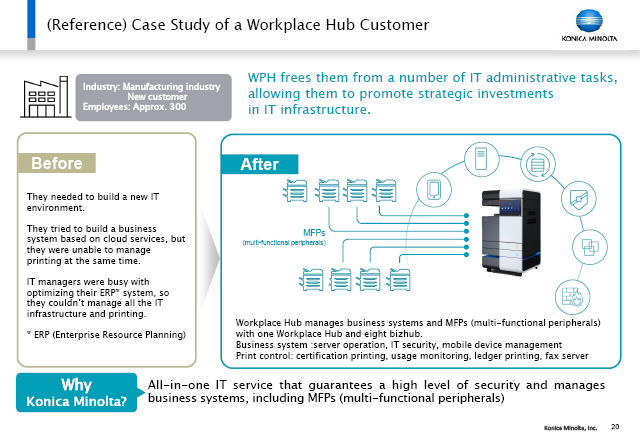

Here is one of the example of customer contracts which has concluded.

This customer is a manufacturing company with approximately 300 employees. In the absence of dedicated IT managers, they were unable to handle the preparation and maintenance of complex IT environment, further printing management. As a result, we were able to contract installing Workplace Hub and eight MFPs as the replacement from a competitor. With connecting Workplace Hub and MFPs, they were able to manage everything from secured printing to usage monitoring, ledger printing, and fax server, as well as system connection, server operation, and mobile device management on a one-stop basis. This is an example of how we have confirmed the response of our aiming customer value.

21/26

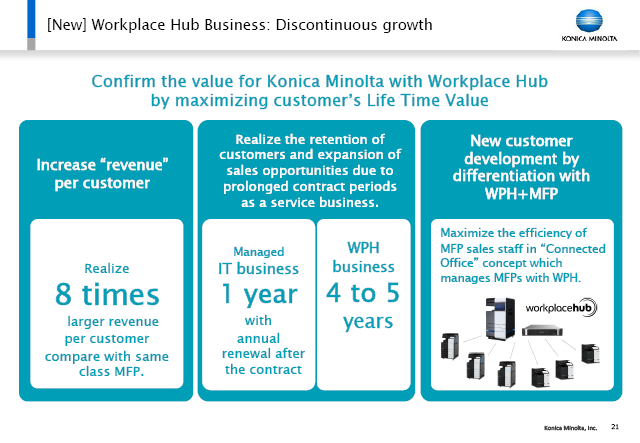

I would like to address why we proceed Workplace Hub furthermore.

Currently, MFPs are in a mature competitive environment, but by focusing on Workplace Hub, the customer unit price will be eight times higher than that of comparable MFPs. In Managed IT business, we have generated revenue of ¥70-80 billion, but the contract of IT service is one year and must be renewed on each year. I am confident that Workplace Hub business will become a four to five years blanket contract and become the foundation of recurring long-term lifetime business. We also differentiate ourselves by combining them with multiple MFPs, as mentioned in the previous example. In particular, even if there are multiple MFPs installed by competitors, Workplace Hub can be used as a gateway to manage the security, including the MFPs of other companies. We will emphasize such customer values in FY2019.

22/26

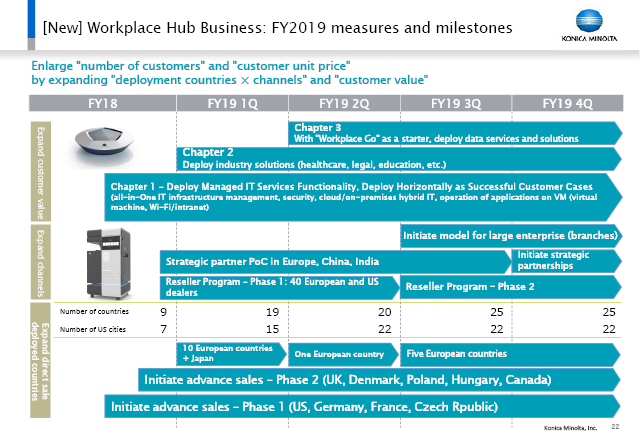

Here is our roadmap.

At present, as the first stage, we are deploying mainly the Managed IT services. In the 1Q of FY2019, we will deploy industry solutions in healthcare, legal, and education industries as the package. In addition, from 2Q, we will begin introducing the data service that provides data analysis named Workplace Go, which is not available in conventional MFPs. As we expand our strategic partnerships, we will deploy the service in 25 countries and 22 cities in the United States by the end of 4Q in FY2019.

23/26

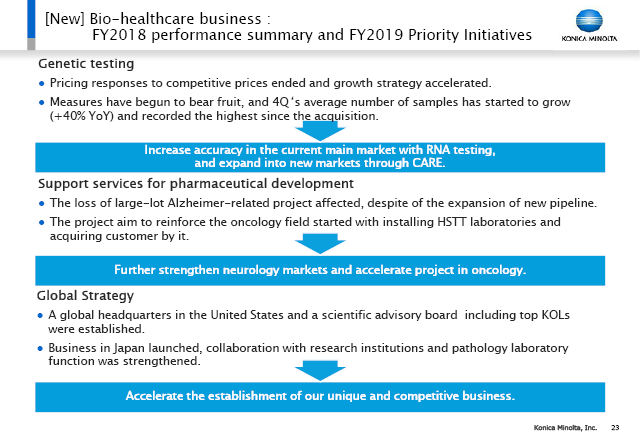

Following the acquisition of Ambry, there were intense pricing offensive from our competitor, and we spent some time to decide how to respond to it. In the meantime, we have implemented the measures such as strengthening the sales organization, developing IT, utilizing large-scale advanced laboratory and bioinformatics, and practicing the use of high-precision analysis databases. We completed the counter measures to the pricing offensive by earning the high reputation from customers. We will implement the measures as the growth strategy from this moment. For reference, the number of samples on 4Q increased by 40% from the previous year, the highest record since the acquisition. In addition, we successfully launched our industry-first development of RNA testing to improve the accuracy of our cancer diagnosis, which began in the second half of FY2018.

On the other hand, we expand our scope to unaffected individuals with providing CARE program in addition to the patients of cancer. This is the measure that can only be implemented by Konica Minolta with the existing mammography business. As the counter measure to the pricing offence, we will pursue precise testing and CARE program in FY2019.

On the other hand, Invicro, which conducts support services for pharmaceutical manufacturing, was affected by the withdrawal from Amyloid-β-targeted Alzheimer’s drugs, but we will proceed in receiving orders related to the trial of Tau-targeted drugs. We will expand our business to the oncology field in addition to the present central nervous system field, and steadily expand projects to more advanced services for pharmaceutical manufacturing with HSTT, which is our unique technologies. HSTT currently has six customers worldwide.

Although our progress is one year behind from the original plan, we intend to make additional needed investments in pathology and data businesses with med-to-long term perspective, aiming for the revenue outlook of more than ¥35.0 billion in FY2019 and ¥100.0 billion in FY2022, without changing our basic stance.

24/26

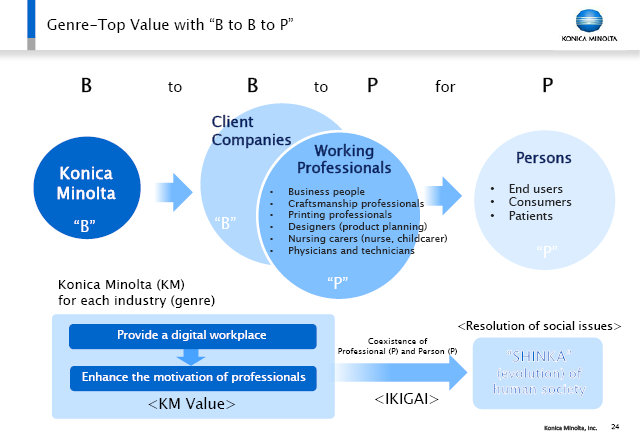

I'll also explain our vision after FY2019.

In our Medium Term Business Plan “SHINKA 2019”, I have said, "We are going to be a digital company with insight into implicit challenges." Our meaning of existence is not only a B to B company. We will provide digital workplaces to professionals workers in B to B, i.e. business people, manufacturing professionals, printing professionals, nursing carers, doctors, and engineers in different business categories (genres). Our value is that we raise their operational efficiency discontinuously and bring out their intrinsic creativity. In other words, our target of value genre-top is B to B to Professional. Empowering professionals' motivation leads to a sense of fulfillment (IKIGAI) among end users, consumers, and patients who exist beyond each B to B. This is the resolution of human society and then SHINKA(evolution). We will proceed with that basic concept in FY2019 without changing it.

25/26

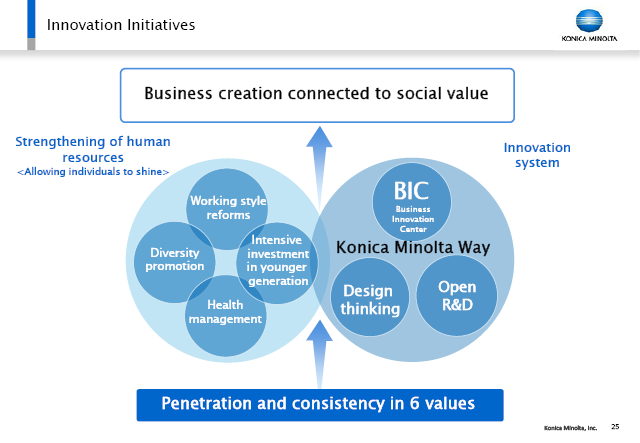

Innovation needs continuous effort. By strengthening our structure for innovation and human resources as shining individuals, we will continue to create businesses that will lead to social values.

It is said that major IT providers are fighting for the leadership of big data in the world. I believe that it is important to realize autonomous, decentralized systems, i.e., analyzing truly significant data in each country, region, and field, and the resolution of each of them on edge basis in real time. I feel that the tide of the era has changed from the fighting for the leadership pursuing scale to pursuing the use of individually dispersed data.

Our policy remains unchanged. We will continue to focus on our unique technologies as "visualizing invisible objects." We will continue to pursue mid-to-long term business growth based on value genre-top strategy by leveraging our edge type of image analysis and IoT in each of the field.

26/26

A3 color MFPs posted 9.8% increase in annual unit sales despite of the carryover of a major project to FY2019 in Europe. The market growth was 4.5%. The non-hard revenue declined compared to the previous fiscal year since the second half of FY2018, but the gross profit has increased because of the improved efficiency in services as I mentioned earlier.

In Professional Print Business, 4Q's year-on-year growth is based on the premise that there had been a large-scale launch of new products in the previous year's 4Q. In the mid production print, where we are focusing our efforts, unit sales grew by 4% compared to 2% in the market for the full fiscal year. As a result, non-hard revenue has increased by more than 6%. The effects of IQ-501 in addition to improving and automating work flows, which are not available by competitors, contributed a positive impact on both hardware and PV. We will also continue to promote these initiatives in FY2019.