|

|||

1/17

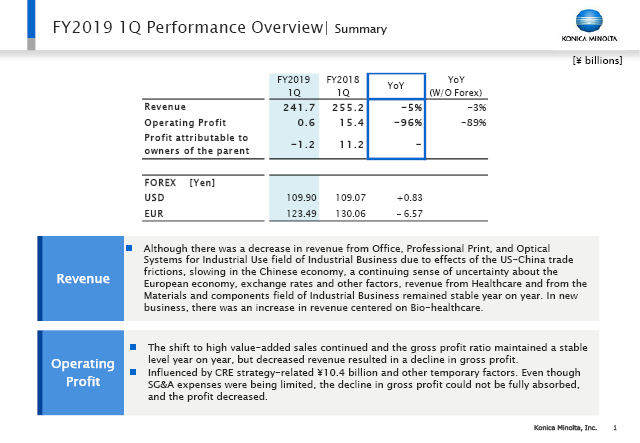

Revenue for 1Q/2019 declined in the Office Business, the Professional Print Business, and the Industrial Business due to the United States-China trade friction, a slowdown in the Chinese economy, continuing uncertainties in the European economy and the accompanying impact of FOREX, particularly a weak euro. In the new businesses, revenue in the bio-healthcare field increased, however, the Group recorded revenue of 241.7 billion yen, a decrease of 5.3% year-on-year. Excluding the impact of FOREX, revenue declined 3%.

As a strengthening core business profitability, a shift towards high value-added sales continued in the current period, and the gross profit margin remained at the same level YoY; however, operating profit fell significantly to 0.6 billion yen, profit attributable to owners of the Company was -1.2 billion yen. This was due to even though SG&A expenses were being limited, the decline in gross profit could not be fully absorbed, and one-off expenses were occurred.

As new MFPs and other products will grow as profit growth drivers increase in each quarter, the 1Q was expected to start at a slow pace, but the result was slightly below the forecast.

In YoY, CRE strategy-related profit of 10.4 billion yen on a net basis was posted in the same period of the previous fiscal year, which is the biggest factor behind the difference.

2/17

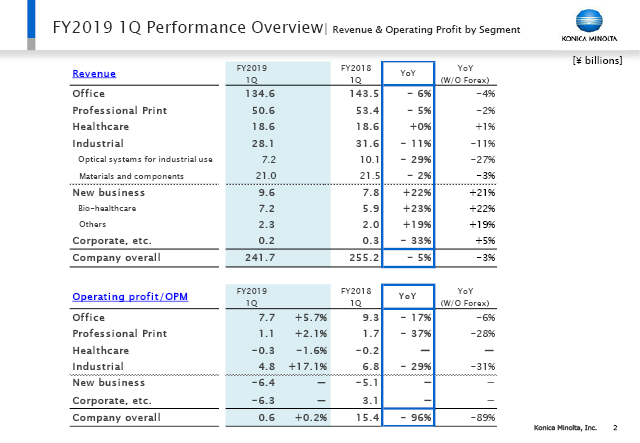

This slide shows the revenue and operating profit by segment.

I will explain the detail of each segment in the following slides.

3/17

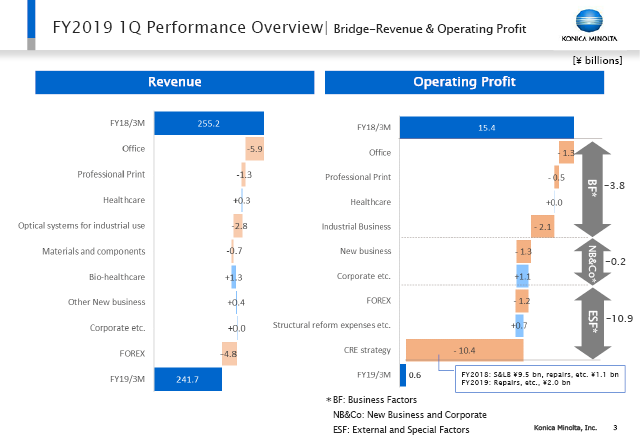

This slide represents the cumulative revenue and operating profit by segment, excluding external and special factors such as forex impact, the liquidation of assets through sale and leaseback based on CRE strategy, and structural reform expenses.

Of the 13.5 billion yen decline in revenue, 4.8 billion yen was due to exchange rates, and the remainder was 8.7 billion yen. Of the 14.8 billion yen decline in profit, the impact on CRE Strategy was 10.4 billion yen, and the FOREX impact was 1.2 billion yen. Therefore, I will explain the key points, focusing on the difference in real terms in operating profit of the remaining 3.2 billion yen.

In the Office Business, gross profit declined due to a decline in sales volume compared to the same period of the previous fiscal year when sales grew significantly, and a delay in the contribution of new products due to taking longer time for selling out of old products. However, the decline in profit was restrained compared to the decline in sales due to the improvement in gross profit margin through cost reductions in manufacturing and services and the reduction in SG&A, including structural reform effects.

The Professional Print Business substantially offset the impact of lower sales by increasing gross profit due to increased sales volume in growing countries and an increase in non-hard sales, however, a temporary cost of 0.4 billion yen in marketing services unit led to a decline in profit as a whole. The results in the Healthcare Business remained almost unchanged from the same period of the previous fiscal year.

In the field of optical systems for industrial use, the extent of the decline in revenue appears to be larger in measuring instrument business unit. This is because the results in 1Q of the previous fiscal year had recorded the large revenue due to the demand from diversification of display products. As we will discuss later, measuring instrument unit was also affected by environmental changes. In the field of materials and components, sales of performance materials unit remained unchanged from the same period of the previous fiscal year, while sales of optical components unit declined due to the impact of Chinese economy slowdown, but the impact of this decline on profits was minimal. IJ (inkjet) component continued to be strong and recorded an increase in revenues without being affected by such factors. In the Industrial Business Segment as a whole, operating profit decreased due to lower revenue year on year.

In New Business, revenues increased mainly in the Bio-healthcare field, but operating profit declined due to the fact that sales have not yet kept pace with the accelerated development of Workplace Hub (WPH) and the one-off expenses of 0.3 billion yen for the retroactive correction for the previous years. Changes in CRE Strategy are as described here.

4/17

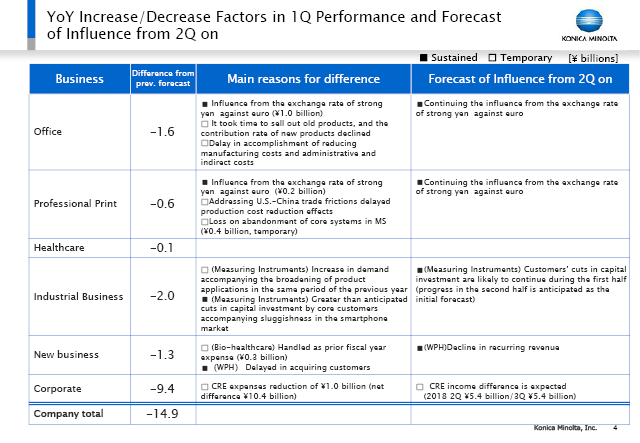

This slide summarizes the main reasons for the difference in the 1Q results described above and the outlook for the impact on 2Q and beyond.

Offices were affected by foreign exchange fluctuations. And as I explained earlier, sellout of old products took time and contributions of new products were delayed. Also, reduction of production cost and administration and indirect costs were slightly lower than expected. Those are the main reasons why the results were slightly lower than planned. From 2Q onward, the impact of the FOREX impact will remain as we reviewed, but we will recover the rest by accelerating the reduction of production cost and administration and indirect costs and the full swing of new products.

Professional Print is also affected by foreign exchange rates, but as I explained earlier, the main reason for the difference was the impact of a 0.4 billion yen one-off expenses on the disposal of old core systems in marketing services unit. In addition, although production cost reductions have lagged somewhat, we plan to catch up with them from 2Q onwards.

In the measuring instrument unit of the Industrial Business, the reason for the difference in 1Q is as I explained earlier. We assume that the restrain capital investment by customers will continue in 2Q, but we expect demand in the second half to be in line with our initial forecasts.

In the New Business, there was a temporary expense of 0.3 billion yen in Bio-healthcare. But the businesses are steadily advancing as anticipated. Although the establishment of WPH's sales system progressed as anticipated, the impact of delays in acquiring customers will affect to the decline in recurring revenues from 2Q onwards.

To sum up, the factors that will continue to be affected after the 2Q are the appreciation of the yen against the euro. The impact on the measuring instrument unit is expected until 2Q.

5/17

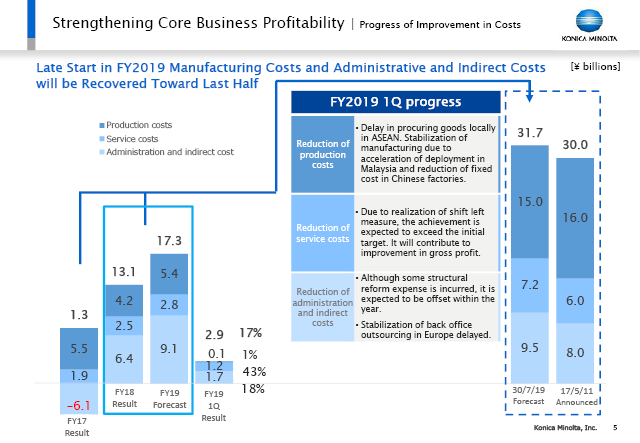

For the production cost, the service costs, and administration and indirect costs reduction measures, as part of strengthening profit capacity of core business, we have revised our annual assumptions from 17.7 billion yen to 17.3 billion yen. The result of total cost result is 2.9 billion yen in 1Q, which is 17% of the total annual forecasted amount.

In production cost, although we made progress by 1% due to the delay in launching new products and the delay in local procurement in ASEAN, we expect to recover from 2Q onwards due to the stabilization of production in Malaysia and the acceleration of fixed cost reduction in China.

Service costs reduction saw 43% progress by the benefits of shift-left initiatives, and non-hard gross profit improved.

With regard to administration and indirect costs, although the progress rate remained at 18% due to certain structural reform expenses at the national level and the delay in stabilizing the outsourcing of back offices functions in Europe in Office segment, but we will recover.

6/17

The following is a detailed explanation of the status of each of our businesses.

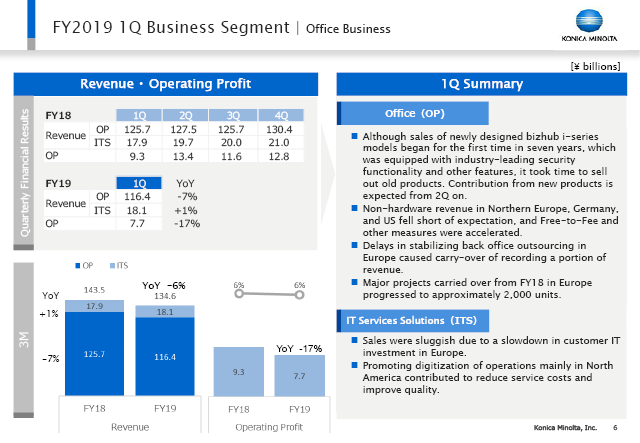

In the office product unit, we launched the bizhub i-Series, the first full renewal model in 7 years equipped with security functions which is first in our industry. However, as it took time to sell off old products, we anticipate that the actual contributions of new products will start in 2Q or later. As a result, sales units and gross profit are expected to improve. Non-hard sales were expected to decline from the previous year, but sales decline in the United Kingdom, Germany, and Northern Europe were more than expected due to the effects of the economic slowdown. On the other hand, we have maintained gross profit through measures such as Free-to-Fee, shift-left initiatives, and extending the lifespan of consumables and parts, and we are further accelerating these measures.

The delay in stabilization of back-office outsourcing in Europe caused delays in invoicing in addition to cost-effectiveness, and sales were partially delayed to 2Q. The installation of large-scale projects in Europe, which were carried over from the previous fiscal year, has progressed to about 2,000 units.

In the IT service solutions unit, sales were sluggish due to a slowdown in IT investment affected by the economic environment in Europe and other factors. We believe that this restraint in IT investment is an opportunity for WPH, which applys the subscription model. In North America, we are promoting digitization of operations and other measures to simultaneously reduce service costs and improve quality.

7/17

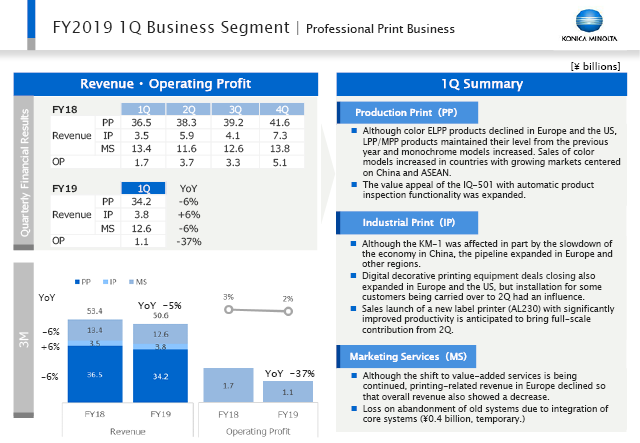

Next, I’m going to explain Professional Print.

In Europe and North America, sales of color Entry Light Production Print (ELPP) declined, but the sum of Light Production (LPP) and Mid Production (MPP) remained unchanged from the previous year, and sales of monochrome models increased. In growing countries, sales of color models increased mainly in ASEAN region and China.

In the industrial printing unit of growth business, although the KM-1 was affected in part by the economic slowdown in China, the pipelines in Europe and other regions increased and revenue increased by 6%. The number of contracts for digital decoration printing equipment has also increased in Europe and North America, but there was a delay in the installation of some customers into the 2Q. In digital label printer, we launched a new AccurioLabel 230 with significantly improved productivity, further the Label Expo was held in September 2019, which is expected to contribute from 2Q onward.

In the marketing services business unit, sales decreased as a whole due to a decline in printing demand in Europe, despite the ongoing shift to providing added value services.

As explained above, a loss on the disposal of the old system due to the integration of the core system amounted to 0.4 billion yen, which was a temporary expense.

8/17

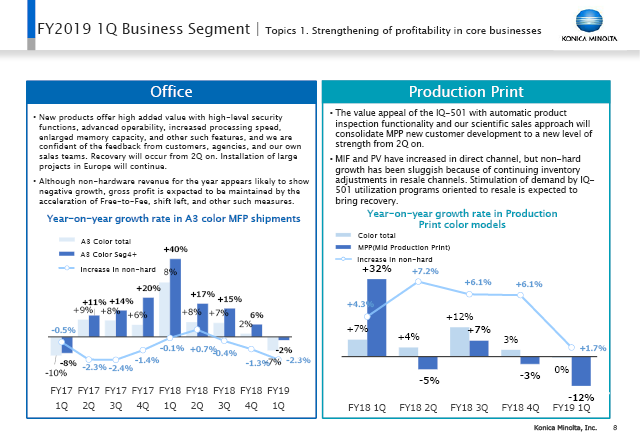

This slide explains the outlook for Offices and Production Print from 2Q onward.

Office Segment remained firm, although unit sales declined 2% from the same period of the previous fiscal year, when Seg4/5 products’ sales units grew significantly. Although it took time to sell out old products in the volume-zone Seg2/3, the new products in this speed segment have benefited from positive feedback from customers, distributors, and our sales teams, thanks to their advanced security functions, easy-to-use user interface, and added value, such as increased processing speed and storage capacity. We expect these new products to make a full-fledged contribution from the 2Q onwards. We will also steadily proceed with the installation of large-scale projects in Europe. Annual sales for non-hard were anticipated as almost flat YoY, but we have reviewed them to be negative, considering the current situation. However, we intend to maintain gross profit through Free-to-Fee, shift-left initiatives, and extension of the lifespan of consumables and parts.

In production print unit, unit sales of color LPPs and MPPs as a whole grew YoY, but unit sales of MPPs declined due in part to significant growth in the same period of the previous fiscal year. In addition to promoting the value of IQ-501 with automatic product inspection system, we will recover momentum by further strengthening the acquisition of new MPPs customers from 2Q onward through scientific sales approaches.

In non-hard, the number of machines installed and print volumes for direct sales are increasing, although it was slightly lower than expected due to continued inventory adjustments in the indirect sales channel. However, demand will be stimulated by the promotion of IQ-501 utilization programs in the indirect sales channel, and the annual outlook remains unchanged from the 2% growth rate of the previous year.

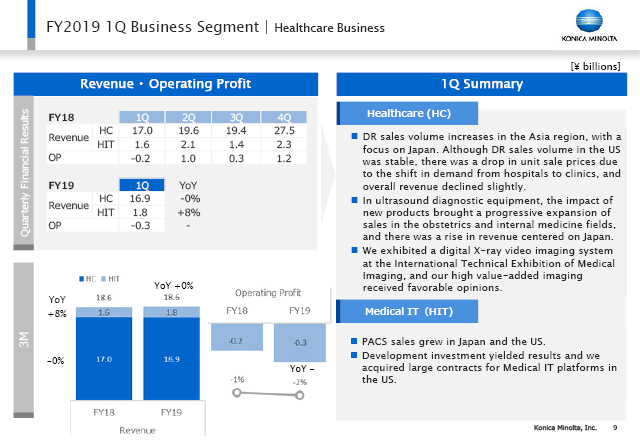

9/17

In healthcare (modality) business unit, there was growth in the sales volume of DR in Asia, primarily in Japan. The sales volume in the US remained at the same level YoY; however, there was a drop in average unit selling prices as a result of a shift in demand for products from the hospital market to the clinic market, leading to a decline in revenue as a whole. With the launch of a new product, sales promotion of diagnostic ultrasound systems to the obstetric and internal medicine fields has been enhanced and, as a result, the sales volume grew primarily in Japan.

We exhibited our new product of digital X-ray video imaging system, also called dynamic analysis, at the International Technical Exhibition of Medical Imaging. This high-value-added imaging received favorable reviews, and we expect future sales growth.

In the medical IT unit, sales of PACS in Japan and the U.S. are growing, and we won large-scale order for medical IT platforms, for which we have invested in R&D. We expect this to contribute to future revenue.

10/17

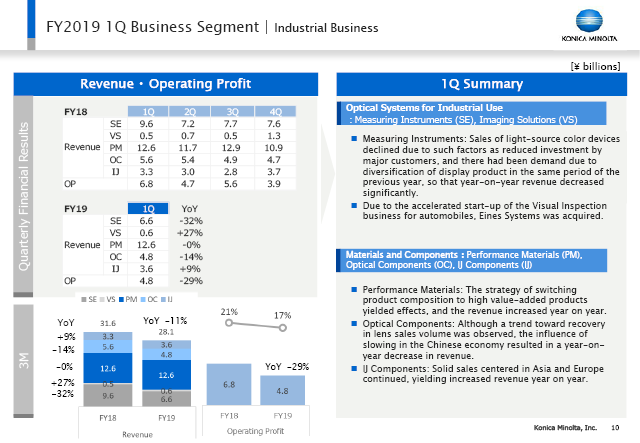

Reasons for increase and decrease in the 1Q results of optical systems for industrial use field, which is centered on measuring instruments unit, is as explained earlier. In 1Q, we acquired Spain-based Eines Systems S.L. to accelerate our automotive visual surface inspection business, which is critical to measuring instrument's growth strategies.

In the field of materials and components, sales generated from the performance materials business unit grew steadily as a result of a strategic shift to high value-added products in a product mix. In optical component business unit, despite the signs of a recovery in the number of lenses sold, revenue decreased YoY affected by a slowdown in the Chinese economy. In the profitable IJ (inkjet) component business unit, revenue increased YoY by sustaining strong sales performance of the previous fiscal year mainly in Asia.

11/17

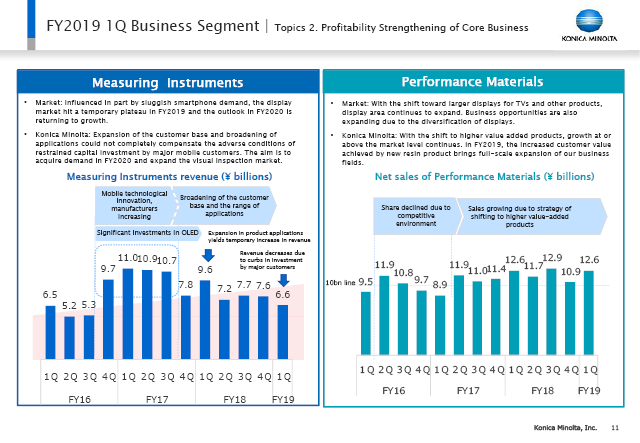

This slide explains the prospects for measuring instrument and performance materials from 2Q onward.

In the display market which is the main target for the measuring instrument unit, our key customers of smartphone manufacturer restrained capital investment due to sluggish demand for smartphones. That was a headwind for us. It appears to be hard to make up even if we cover the expansion of our client base and of display applications, but we expect for investments by our key customers for new smartphone models in FY2020 and we anticipate to return to a growth track in 4Q. In addition, we will accelerate the launch of the automotive visual surface inspection business, including in effect of acquisitions, as I mentioned earlier.

In performance materials, display area continues to expand with the shift to larger displays for TVs, and business opportunities are expanding with the diversification of displays. In such a market environment, we are continuing to grow faster than the market level by shifting to higher value-added products and our customers' evaluations of SANUQI and other new resin-based products have exceeded expectations in this fiscal year. We will work to further improve our customer value and expand our business domains.

12/17

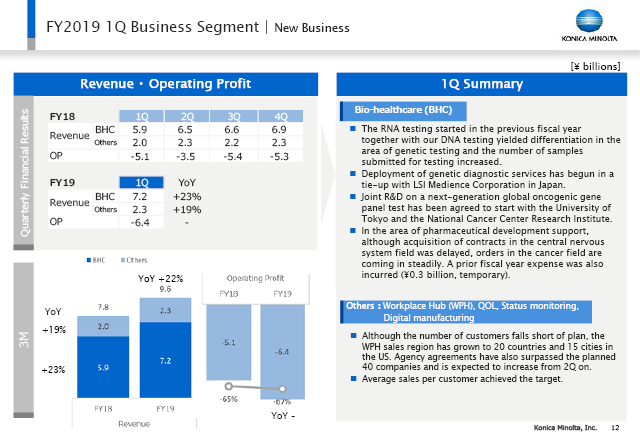

Here we discuss New Businesses.

In bio-healthcare, genetic testing business saw a 23% increase in revenue YoY. Together with DNA testing, RNA testing started in the previous fiscal year yielded differentiation in the area of genetic testing and the number of samples submitted for testing increased. In Japan, we formed a partnership with LSI Medience Corporation and launched a genetic diagnostic service. We also agreed to launch a joint R&D with the University of Tokyo and the National Cancer Center Research Institute for the next-generation global oncogenic gene test, the world's highest level. We expect synergies to be generated by combining the foundation of the Todai OncoPanel, a world-leading oncogenic panel test, which analyzes both DNA and RNA, with the strengths of US-based Ambry Genetics, Inc. Ambry Genetics is the world leader in germline mutation detection technology and has commercialized the world's first RNA testing to evaluate innovative genetic variability.

In the area of pharmaceutical development support, we still have a slight impact from cancelation of central nervous system projects, specifically, the discontinuation of the development of amyloid-beta-based Alzheimer drugs by customers. But we are accelerating the acquisition of Tau-based Alzheimer drugs development and oncology clinical trials. In the pharmaceutical development support, disposal of prior-year expenses amounted to 0.3 billion yen as temporary expenses.

In the WPH, sales territory has now covered 20 countries, and 15 cities in the U.S. The number of dealers has exceeded the target of 40 companies in terms of agency contracts. However, the number of customers has been below the target, and we will work to recover by taking measures such as strengthening incentive schemes. Meanwhile, the average unit price of acquired customers exceeded the plan, and we feel confident responses on our customer value.

13/17

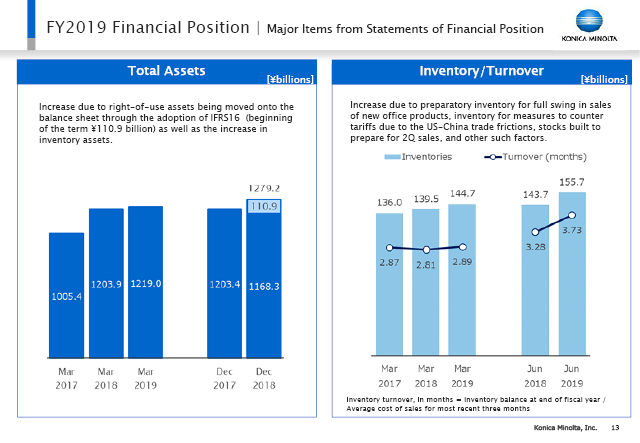

Total assets increased 110.9 billion yen at the beginning of the term as a result of the right-of-use assets being moved onto the balance sheet through the adoption of IFRS16, which is new accounting rule for leasing. This led the increase of total assets from the end of the previous fiscal year and from the same period of the previous fiscal year.

Inventory is temporarily increasing from both of the end of the previous period and from the same period of the previous fiscal year. They are preparatory inventory for full-swing in sales of new office products, inventory for measures to counter tariffs due to the fourth action of US-China trade frictions, and stocks built to prepare for 2Q sales.

14/17

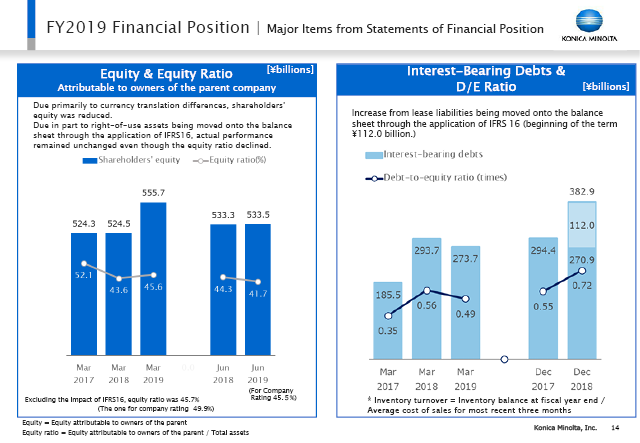

Equity decreased from the previous fiscal year-end due mainly to foreign currency translation differences and dividends.

Equity ratio decreased due to an increase in total assets, but this was due to an accounting regulation change. In fact, our actual performance remained unchanged, so our financial soundness has no problem. Excluding this effect, for company rating's equity ratio is approaching up to 50%.

Interest-bearing debts also increased by 112 billion yen at the beginning of the term, as a result of the right-of-use assets being moved onto the balance sheet through the adoption of IFRS16. As a result, D/E ratio has increased, but this is again has no change in real terms.. Excluding this impact, D/E ratio was 0.50, maintaining the level at the end of the previous fiscal year.

15/17

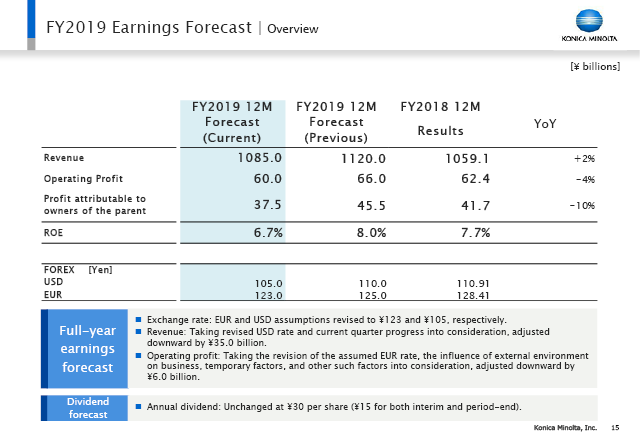

This year's earnings forecast.

The assumptions for the foreign exchange rate will be revised from ¥125 to ¥123 for the euro and from ¥110 to ¥105 for the U.S. dollar. In light of this change in foreign exchange rate assumptions, particularly the impact of the change in the U.S. dollar and progress in the current quarter, revenue has revised its forecast downward by 35 billion yen.

The impact of foreign exchange rate revise on operating profit is approximately 2 billion yen. As for the impact other than foreign exchange rate, we forecast as follows; the impact of the review of non-hard sales assumptions at offices unit will be 1 billion yen, the impacts appeared in 1Q and lasting to 2Q in the measuring instrument unit will be approximately 2 billion yen, and the reflection of the forecast review in New Business will be 2 billion yen, including 0.3 billion yen of a temporary cost. As a result, the net revision was 6 billion yen downward, reflecting the 1 billion yen decrease in CRE expenses at the corporate level. This review resulted in a year-on-year decline in profit, but I would like to add that operating profit, excluding special factors, is still increase in real terms. Annual dividend forecast remains unchanged.

With regard to Core Business, although there are temporary changes in business environment in the measuring instrument, there are no changes to medium- to long-term growth scenarios. While keeping a close watch on the impact of environmental changes in segments of the Office and the Professional Print, we will increase profits by sharpening regional strategies, reducing costs, and controlling SG&A.

With regard to New Businesses, our policy of "expanding businesses by prioritizing management resources" remains unchanged. Upfront investments will lead to top-line growth, but we will continue to assess sales growth based on sales capacity and strive to achieve our goals by controlling SG&A. Bio-healthcare will increase the number of genetic testing samples by strengthening competitiveness through RNA testing. In the second half, we will expand the target markets through CARE program, firmly confirm the takeoff of top-line growth, and achieve improved revenue and profit. Although the sales outlook for WPH declines due to the delay in acquiring customers, we will focus on acquiring customers by efficiently increasing the number of customer leads through various measures.

16/17

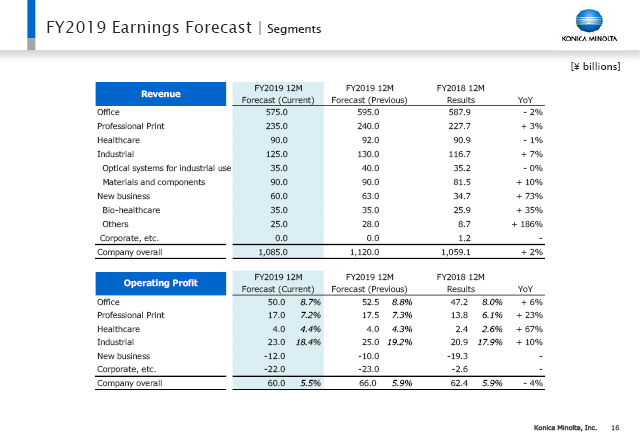

The revenue forecast by segment after the review is shown in this table.

This reflects the content explained so far.

17/17

As a strengthening core business profitability, a shift towards high value-added sales continued in the current period, and the gross profit margin remained at the same level YoY; however, operating profit fell significantly to 0.6 billion yen, profit attributable to owners of the Company was -1.2 billion yen. This was due to even though SG&A expenses were being limited, the decline in gross profit could not be fully absorbed, and one-off expenses were occurred.

As new MFPs and other products will grow as profit growth drivers increase in each quarter, the 1Q was expected to start at a slow pace, but the result was slightly below the forecast.

In YoY, CRE strategy-related profit of 10.4 billion yen on a net basis was posted in the same period of the previous fiscal year, which is the biggest factor behind the difference.