|

|||

|

|

|

||||||||||||

|

||||||||||||

|

|

1/22

Today, I would like to convey these 3 points. I will provide detailed explanations on the following pages.

2/22

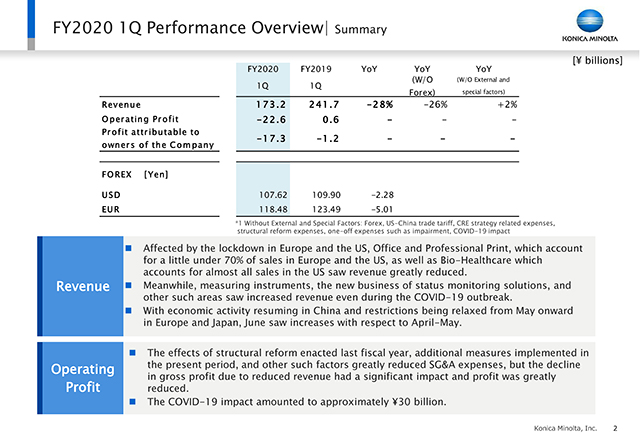

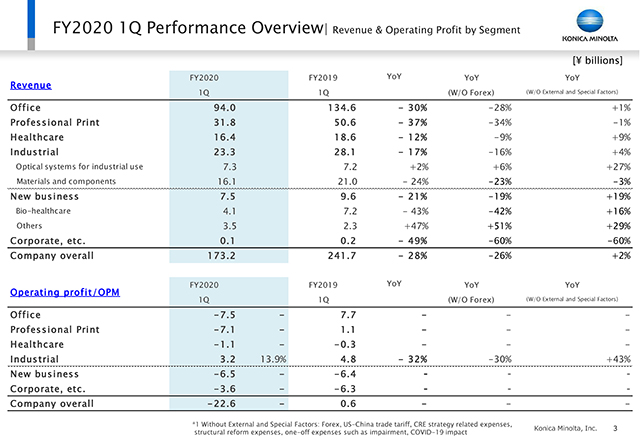

This is a summary of FY2020 1Q financial results. Revenue was ¥173.2 billion, a YoY decline of 28%. Operating profit was negative ¥22.6 billion, resulting in a loss. Lockdowns continued in April and May, particularly in Europe and the U.S., and Office Business and Professional Print Business were significantly affected. Even in the COVID-19 situation, revenue of measuring instruments unit, status monitoring in the new business, and other businesses increased.

The decline in gross profit caused from the decline in revenue was a major factor affecting the operating profit. The impact of COVID-19 on operating profit in 1Q is estimated to be approximately ¥30.0 billion. Although we implemented structural reform in FY2019 and reduced fixed cost through the urgent measures described in May this year, we were unable to absorb all of the impact from the decline in revenue, and regretfully we recorded an operating loss.

3/22

This slide shows a breakdown of revenue and operating profit by segments. The decline in gross profit from revenue or the decline in the gross profit ratio in Office Business and Professional Print Business impacted the overall performance. In the U.S., bio-healthcare business was also affected by a delay in recovering from the impact of COVID-19.

Despite the impact of COVID-19, revenue increased in measuring instrument in the optical systems for industrial use field and status monitoring in new business due to a sharp increase in demand for thermal cameras manufactured by MOBOTIX.

Operating profit will be discussed in detail in the following section.

4/22

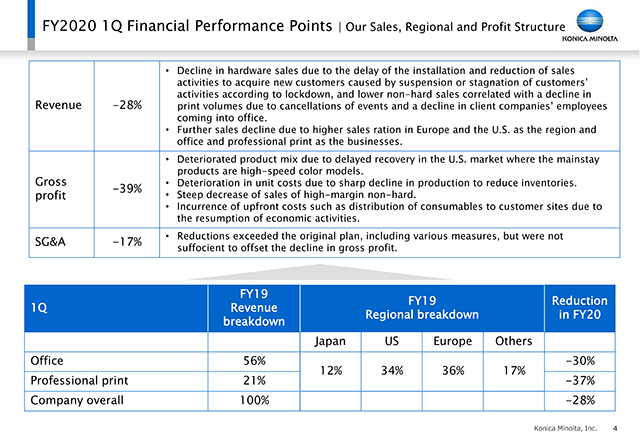

One of the points in financial performance in 1Q is a decrease in revenue. The delays in the installation caused by the suspension or stagnation of customer activities due to lockdowns and the slowdown in the acquisition of new customers resulted in a decline in hardware sales.

In addition, print volume, which are the main source of earnings, fell sharply due to cancellations of events and a decline in attendance at office by employees of client companies.

Consequently, revenue decreased by 28%.

These declines are common across our industry, but in our case, Office Business and Professional Print Business account for 77% of our entire revenue. Looking at the geographical composition of Office Business and Professional Print Business, nearly 90% of our clients are located outside of Japan. The impact of COVID-19 was relatively minor in Japan. As a result, nearly 70% of revenue were affected by COVID-19.

Gross profit declines were negative 39%, more than the rate of decline in revenue. Looking at the mainstay Office Business, gross profit decreased overall due to factors such as product mix, regional mix, and customer mix, and the gross profit ratio also deteriorated. In addition, manufacturing profit and losses due to the reduction of safety inventories, while prioritizing cash flow as a policy, also negatively impacted gross profit. The decline in non-hard with a high gross profit ratio, also led to a decline in the profit margin. In addition, the increase in the number of customers replacing consumables and parts to coincide with the resumption of machine operations, particularly in the case of direct sales customers, led to a temporary increase in material costs.

SG&A expenses were reduced by ¥19.0 billion YoY as a result of accelerated efforts that exceeded expectations, but this was not enough to offset the decline in gross profit.

Regarding new businesses, we have carefully selected how to use our expenditures, but we believe that this is the time to hold on, and we are not going to put on the quick brakes.

5/22

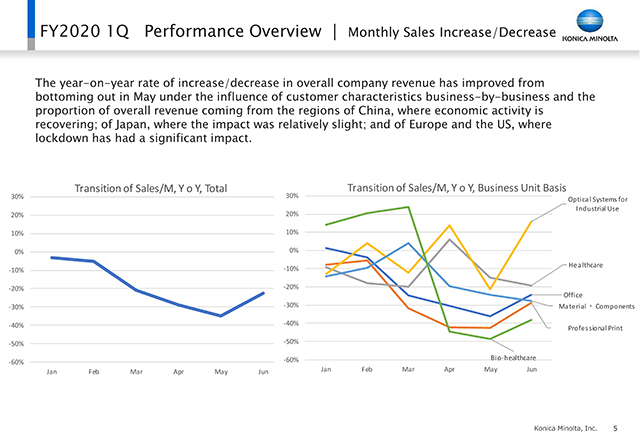

This slide shows the monthly changes in revenue growth rate from 4Q of FY2019.

Sales bottomed out in May, although there are slight variations according to business, and all businesses began to show a solid recovery trend in June.

6/22

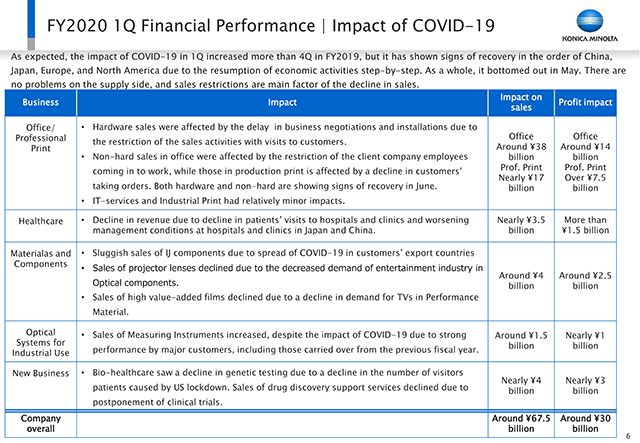

This slide shows the impact of COVID-19 on 1Q.

Revenue were affected by approximately ¥67.5 billion and operating profit by approximately ¥30.0 billion. As for Office Business and Professional Print Business, I explained earlier.

Healthcare sales declined due to a decrease in the number of patients coming to hospitals. In addition, there was an impact that business negotiations could not proceed as we wanted.

With regard to inkjet heads in materials components, printers with our heads are exported mainly from Chinese manufacturers, but their export destinations stagnated due to the impact of COVID-19. In optical components, sales of lenses for projectors are declining.

In performance materials, sales of high-value-added films decreased due to a decline in the demand for TVs.

In optical systems for industrial use, we were able to ship orders for the measuring instrument unit that we carried over from the previous fiscal year. In addition, we received orders from a major customer and revenue increased despite the impact of COVID-19.

Bio-healthcare in new business was impacted by the U.S. lockdown.

7/22

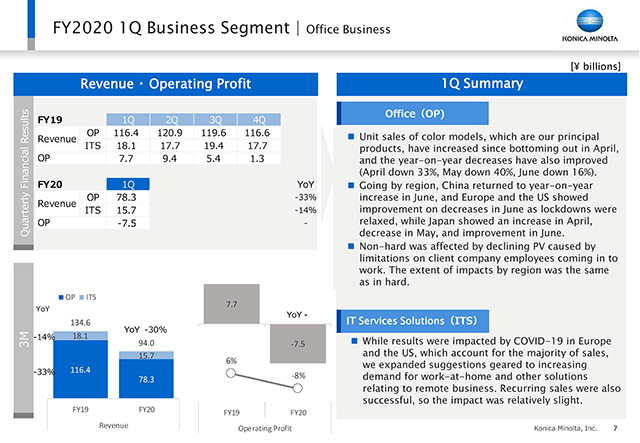

From here, we will show points by segment.

The Office Business is not just negative information. In the European market, in our mainstay A3 color MFPs, we are striving to keep the rate of decline lower than the overall market. This reflects the momentum of the new product launched in the previous fiscal year. Looking at developments by region, sales in China has shown a recovery, with year-on-year increases since June.

In IT services solution, monthly recurring is the main source of revenue. The extent of the YoY decline is also relatively small, and it is expected to continue in 2Q and beyond.

8/22

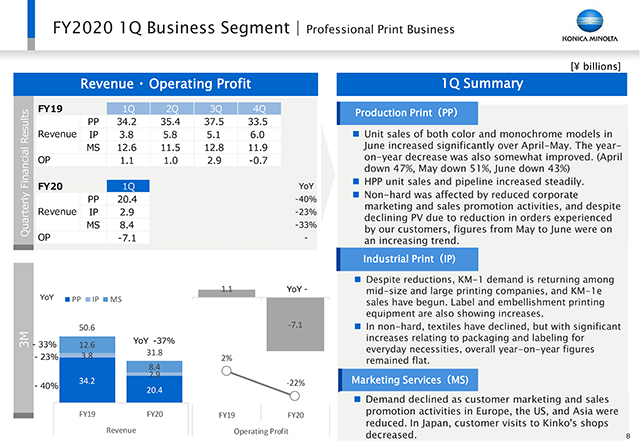

In production print, the Chinese market is recovering, and new high-speed color models launched in February are growing steadily in terms of both sales volume and pipeline.

Demand for industrial printing, including non-hard for label printers, is strong. Progress was not affected by the impact of COVID-19.

9/22

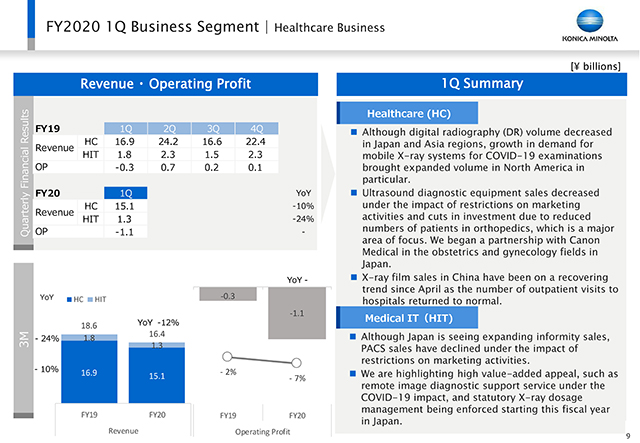

Sales volume of DR decreased in Japan and other Asian countries, however, we have been able to increase our sales volume, particularly in North America, in response to the increase in demand for mobile X-ray systems.

10/22

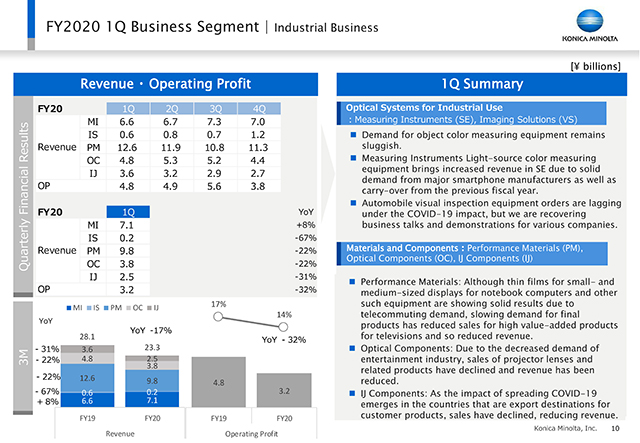

Sales of measuring instruments increased due to the strong demand from major smartphone company and the carry-over from the previous fiscal year.

Material components also showed signs of positive growth, as I explained earlier.

11/22

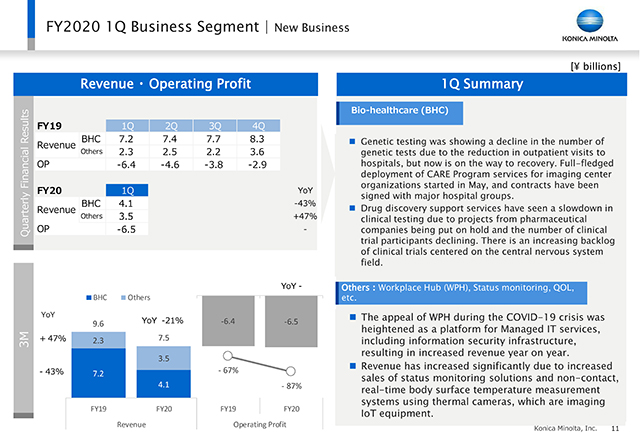

In bio-healthcare, genetic testing suffered temporarily due to the inability of patients to visit hospitals. However, this is an area where demand will surely return in the future.

In addition, we launched a full-scale CARE Program for healthy people in May, and are making steady progress with contracts with major hospitals.

Although Workplace Hub received orders, there are still nearly 70 units that could not be installed due to COVID-19, but they will be resolved in the future.

12/22

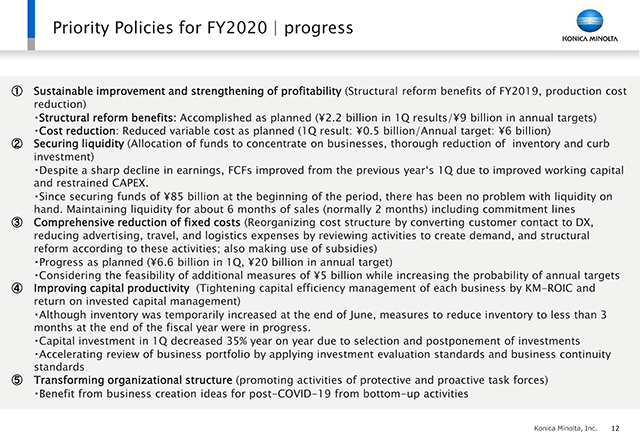

At the time of the announcement of FY2019 financial results in May, we raised 5 priority policies in FY2020 management policy. I would like to explain about these progress as of the end of 1Q.

Sustained improvement and strengthening of profitability; Structural reform benefits were ¥2.2 billion, which was as planned against the annual target. As to the manufacturing cost reduction, we made progress of 0.5 billion in 1Q against the annual target of ¥6.0 billion.

Securing liquidity; We secured funds of ¥85.0 billion at the beginning of the fiscal year, but in reality we have dip very little about it, and our cash flow improved from the previous fiscal year.

Comprehensive reduction of fixed costs; We have set an annual target of ¥20.0 billion as an emergency measure. Including one-time expense accruals, we made net progress of ¥6.6 billion in 1Q. However, as I will explain later, we will further accelerate our efforts to reduce fixed cost by 20.0 to 25.0 billion yen annually.

Improving capital productivity; As of the end of June, we were unable to achieve a significant improvement in inventory reduction from the end of March. However, we are making steady progress with measures to reduce inventories.

13/22

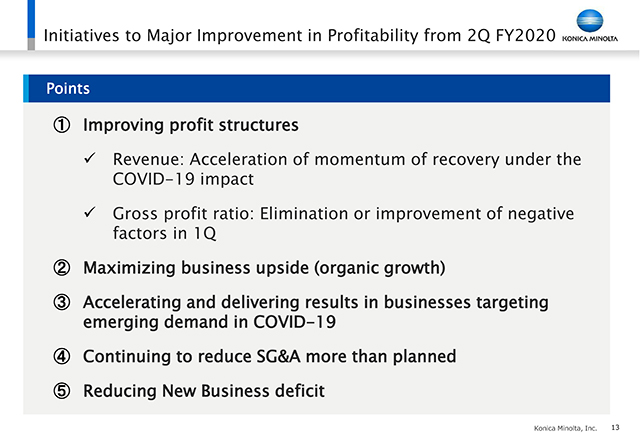

In the following section, I will explain in detail about improving profit structures, business upside, and delivering results for emerged demand from COVID-19.

We have touched on reducing SG&A and reducing new business deficit in the previous section, so we will skip it here.

14/22

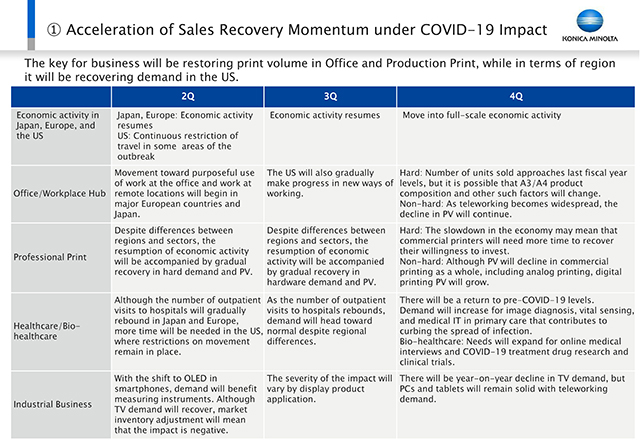

Here is the explanation about the impact of COVID-19 from 2Q onward.

In the Office Business, the point is how the print volume shifts. This will be largely related to the way in which the movement between "go to the office" and "work from home" ultimately settles in each country. In Japan, Germany, and other countries, print volume have already returned to about 85% in June. Over the long term, we do not think that print volume at office will fully return to 100%. However, we expect print volume to return to close to 90% within this fiscal year or even slightly slipped to the next fiscal year.

In the commercial printing industry, the total print volume, including offset printing, will be decreasing. However, in the digital printing business in which we operate, the value of digital on-demand printing, which can take advantage of its strengths in labor saving and automation, will increase further. I believe that opportunities will expand even in COVID-19 situation. However, we need to closely monitor future trends in terms of the time horizon.

Healthcare and bio-healthcare are confident that actual demand will increase as patients return to hospitals and clinics. However, we believe that we need to pay close attention to how to recover demand in the U.S., where there are ongoing restrictions on outing.

In Industrial Business, there will be slight up and down since 2Q in response to client companies demand. However, SANUQI, new resin film, is expected to contribute to revenue going forward.

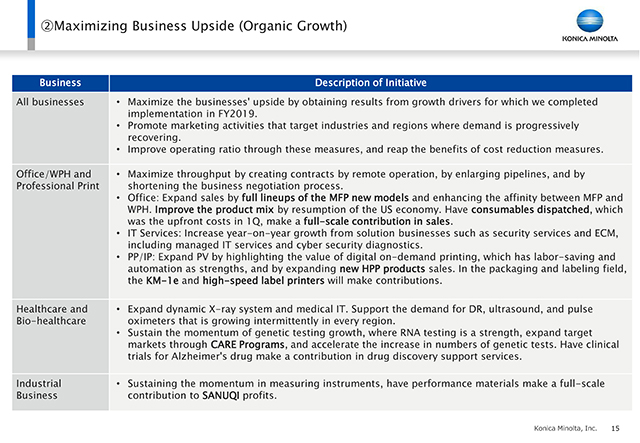

15/22

The most important thing is how to create an upside in order to assess conditions after 2Q. Subsequent to this, there is the revitalization of the economy through the removal of restrictions on mobility. Nevertheless, even if this is not the case, we will implement measures to achieve the kind of organic growth that we have been aiming for.

In Office Business, we maintain momentum with our new MFP product lineup. A solid response has been seen in Europe in 1Q. Furthermore, as the U.S. economy recovers, the regional mix will improve, thereby contributing to an improvement in the gross profit ratio. In addition, we will strengthen our efforts to control the inventory of consumables for direct sales customers in conjunction with sales.

In IT services, we are aiming for higher growth than the previous fiscal year through security services, including cyber security diagnostics, and solution businesses, such as ECM.

In production print, we will expand sales of new HPP products, which in turn will lead to an increase in print volume. We will also hasten the contribution of sales from high-end inkjet printers and high-speed label printers.

Healthcare and Industrial Business are as explained above.

16/22

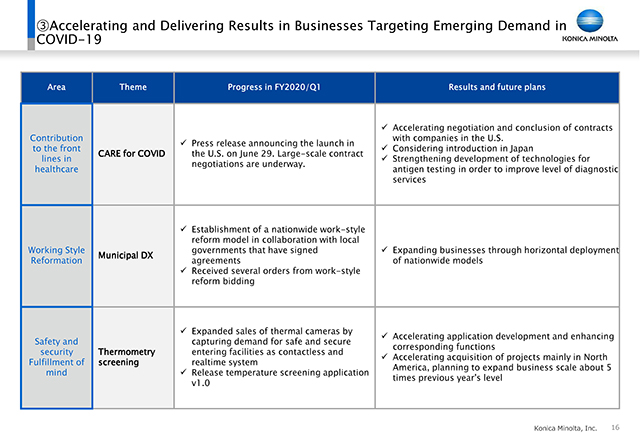

In this section, we will introduce 3 areas, namely, the acceleration of businesses where demand has emerged from COVID-19 and the areas in which it will contribute to the revenue in the current fiscal year.

The first is to contribute to the healthcare field. CARE for COVID in bio-healthcare is to deploy CARE Program to COVID-19 testing. It provides PCR tests and antigen or antibody tests as necessary. We started it in the U.S. and are considering introducing it in Japan.

The second is working style reforms related services for local governments. We are already working with several local governments. We will provide solutions for how they should make improvements, including assessments. We have already enhanced our ability to draw out solutions, and we will horizontally deploy them to municipalities nationwide to expand our businesses.

The third is contactless and realtime thermometry screening solutions. We see this as an opportunity throughout the fiscal year, rather than the one where demand disappears in the first quarter.

17/22

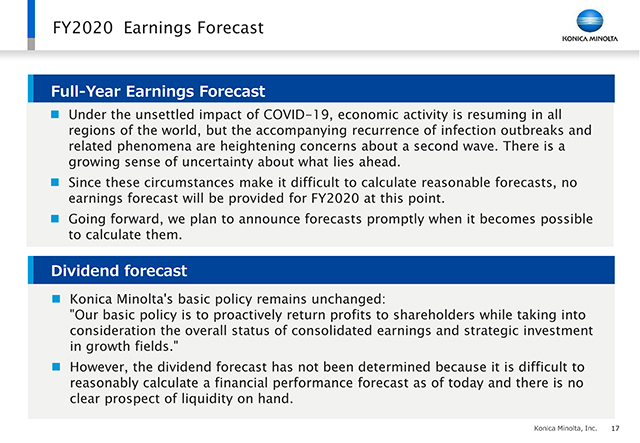

Earnings forecast for FY2020 are expected to be publicly available at the time of the announcement of financial results for the first half of the fiscal year, as it remains difficult to calculate them rationally. The same applies to dividends.

18/22

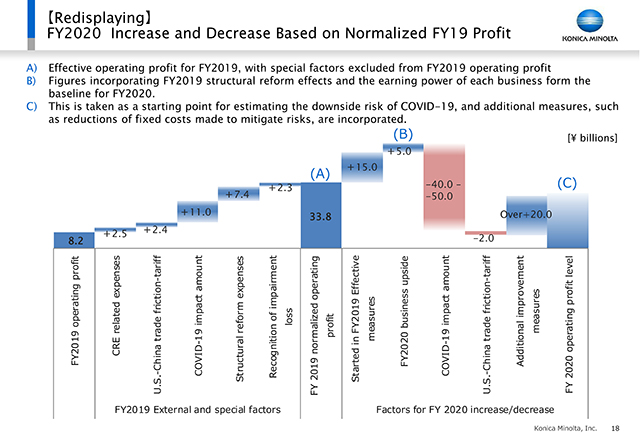

This slide is the same as the one shown at FY2019 financial results briefing session on May 26.

Operating loss in 1Q was ¥22.6 billion, so frankly speaking, the impact is expanding more than expected, mainly in the U.S. In addition, we need to carefully monitor its future recovery.

Consequently, the impact of COVID-19 may increase by up to ¥10.0 billion from the previous forecast of ¥40.0 to ¥50.0 billion.

On the other hand, additional improvement measures in FY2020 had a positive impact of ¥20.0 billion plus alpha, but we are aiming for a minimum of ¥25.0 billion for the full fiscal year. In addition, through the provision of services that take into account the business upside from 2Q and trends in social issues that I have explained, we are prepared to focus on securing operating profit more than ¥10.0 billion per year at all efforts.

19/22

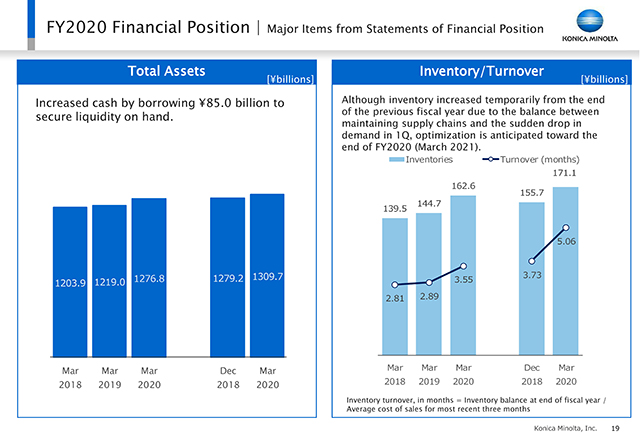

Inventory will be kept down to a turnover of less than 3 months at the end of the fiscal year.

As of the end of June, these measures have not yet been effective, but we have already implemented them. We will step up our efforts toward the end of the fiscal year.

20/22

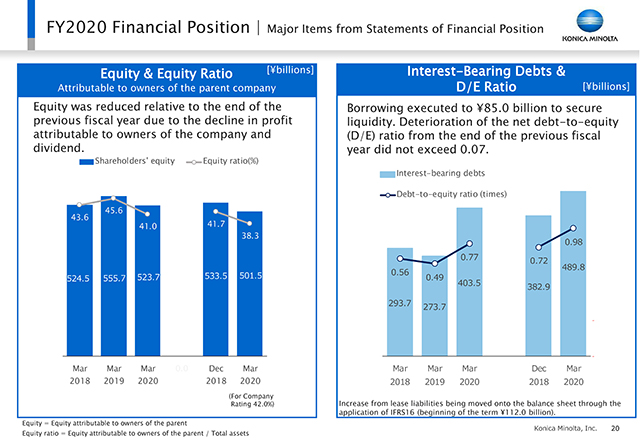

Equity decreased due to a loss. On the other hand, interest-bearing debts increased as a result of raising more than ¥85.0 billion at the beginning of the fiscal year, but the deterioration in the net D/E ratio remained at 0.07 as the majority of cash remained in hand.

21/22

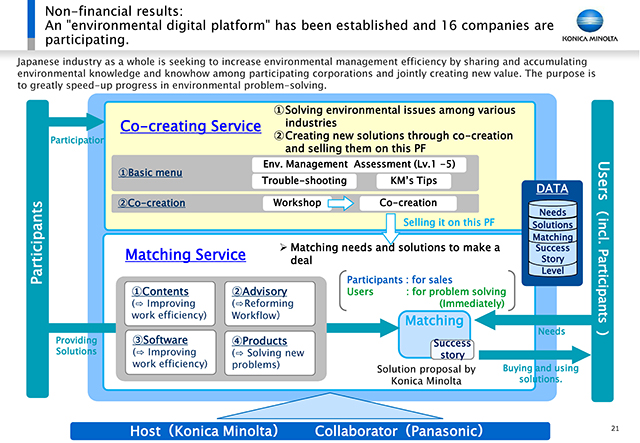

Finally, I would like to introduce our non-financial efforts.

We took the lead in establishing an "Environmental Digital Platform" in 1Q with the participation of 16 companies. It is a "Co-Creation Service" to dramatically improve solutions to environmental problems encountered by the entire Japanese industry. The key point is to bring together environmentally advanced companies from across industries to create solutions for environmental issues. With the "Matching Service", we aim to make it possible for companies that are in trouble to receive the provision of environmental solutions including the solutions created through "Co-Creation Service".

Our 1Q results were very challenging. However, from 2Q onward, we will first work to recover our gross profit ratio while recovering sales, and will continue to focus on achieving more than ¥10.0 billion of operating profit.

22/22