|

|||

We thank you for participating in our financial results briefing session today.

I will explain our financial results for the Q3, which we disclosed at 15:00.

1/20

First, let me introduce the points that I would like to explain today.

Regarding financial performance for the Q3, both operating profit and profit attributable to owners of the Company moved into the black in the Q3, as anticipated at the time of the briefing session of the 2Q.

Cash creation capability also improved significantly, with free cash flows recording a surplus and expanding following the Q2.

IT-services, Workplace Hub, Industry, and Healthcare, which are positioned as the pillars of our growth, saw higher sales, leading the entire company.

Since the Q1, SG&A has kept below ¥100 billion, maintaining a profitable operating structure.

Next, regarding the full-year earnings forecast for FY20, we have unchanged the forecast for revenue, operating profit, profit attributable to owners of the Company, and dividend.

We expect free cash flows to be projecting substantial annual surplus for the first time since FY2014, excluding sale-leaseback, taking into account our progress by the Q3.

In the Q4, we will maximize revenue and profits by focusing our resources on growing areas from the perspective of businesses, regions, and customers. Taking this point into account, we have reviewed the balance of earnings forecast between businesses.

In addition, we will continue to focus on maintaining quarterly SG&A below ¥100 billion.

2/20

I will explain each item in detail.

3/20

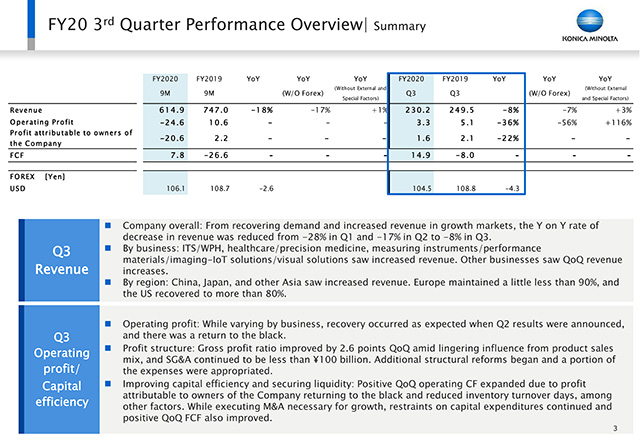

This is the summary of the Q3 financial performance.

From recovering demand and increased revenue in growth markets, the YoY rate of decrease in revenue was reduced from -28% in the Q1 and -17% in the Q2 to -8% in the Q3.

By business, revenue of IT services/Workplace Hub, healthcare/precision medicine, and measuring instruments/performance materials, all of which are the pillars of growth, rose YoY. Revenues from other businesses also increased from the Q2.

By region, sales in China, Japan, and other Asia saw increased revenue. Europe maintained a little less than 90%, and the U.S. recovered to more than 80% following the Q2.

Operating profit in the Q3 recovered as expected at the briefing session of the 2Q, and it returned to the black while varying by business,

Gross profit ratio improved by 2.6 points QoQ partly due to the elimination of the impact of production adjustments amid lingering influence from product sales mix.SG&A continued to be less than ¥100 billion on a quarterly basis and we are improving our earnings structure. We have begun the additional structural reform that we announced at the briefing session of the 2Q, and have recorded ¥0.7 billion as a portion of expenses out of the planned ¥6.5 billion.

In the 4Q, positive QoQ operating cash flows expanded due to profit returning to the black and cash conversion cycle improved, mainly because of reduced inventory turnover days. While executing M&A necessary for growth, restraints on capital expenditures continued and positive QoQ free cash flows also expanded.

4/20

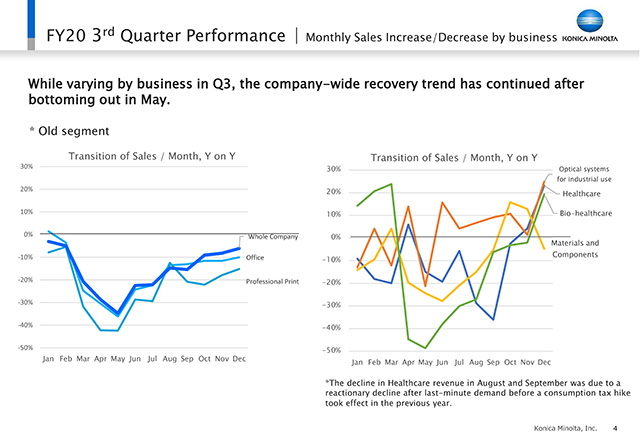

These graphs represent transition of sales for the whole Company and by business. The figures in this section is presented in the former segments.

After bottoming out in May, you can see monthly sales recovery trends. Since October, we saw a strong or weak recovery trend by each business. This is attributable to the recovery in economic activity by the region in which the business is conducted and the characteristics of the industry and customers.

The recovery in Office Business has slowed, and the recovery in Professional Print has been delayed.

Meanwhile, optical systems for industrial use, centered on measuring instruments, maintained its sales growth momentum, and materials components, centered on performance materials, turned to sales growth trend. Healthcare and bio-healthcare also turned to an upward trend.

In this way, although there are shown strengths and weaknesses by each business, the sales of the company as a whole continue to recover.

5/20

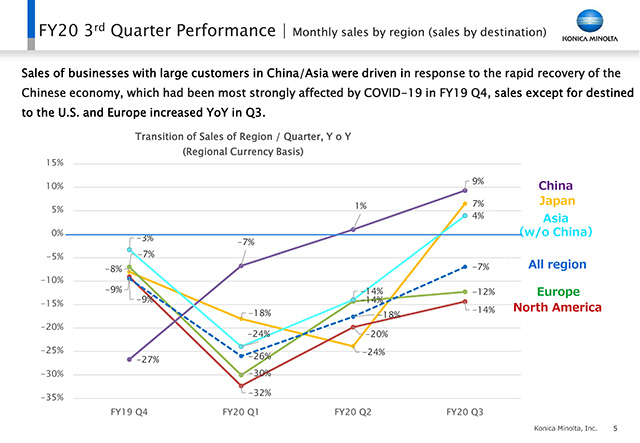

As I mentioned earlier, I will explain the situation by region with this chart, transition of sales of region.

In the Q4 of FY19, the Chinese economy, which was most strongly affected by COVID-19, recovered rapidly. Our revenue began to rose from the Q2, and it increased by 9% in the Q3. Asia other than China also saw an increase in sales in the 3Q. In Japan, sales continued to decline in QoQ basis until the Q2, partly due to demand before the consumption tax increase in FY19, but sales began to rise in the Q3. The sales in regions other than Europe and the United States also began to rise.

In Europe, the recovery has become sluggish partly due to the impact of the lockdown, but North America continued a comparative recovery trend.

6/20

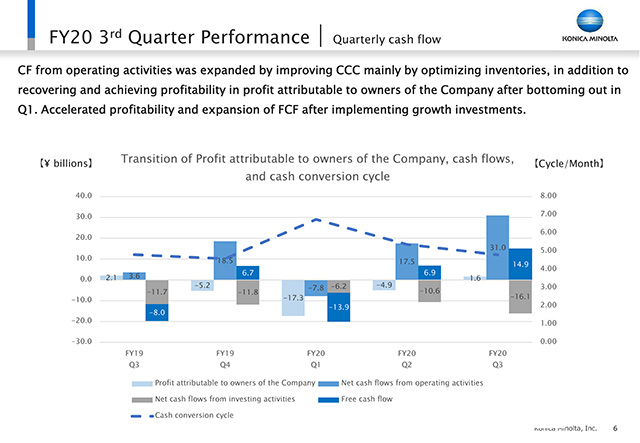

I will explain the status of free cash flows.

Besides profit attributable to owners of the Company recovered after bottoming out in the Q1 and became in the black in the Q3, the cash conversion cycle, which temporarily deteriorated, improved due to measures mainly to optimize inventories. As a result, operating cash flows, which returned in the black in the Q2, further expanded in the Q3. We invested the operating cash in the acquisition of Specim in measuring instruments unit for our growth in the future and additionally increased the free cash flows on a quarterly basis.

7/20

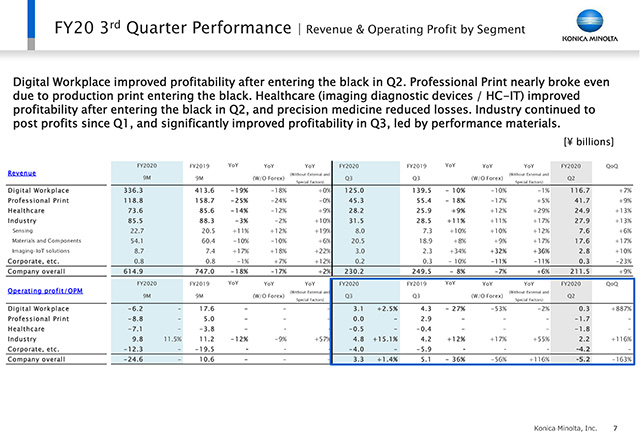

This is the status of revenue and operating profit by segments.

Digital Workspace Business, which turned into the black in the Q2, expanded its profit.

Professional Print Business reached break-even as production print turned into the black.

Healthcare Business reduced the losses and approached to the break-even as a result of expanding profit in medical IT and diagnostic imaging equipment, which were profitable in the Q2, and reducing the losses of precision medicine.

Industry Business has continued to be in the black since the Q1, and significantly improved profitability in the Q3, led by performance materials. As a result, it increased operating profit compared to FY19.

8/20

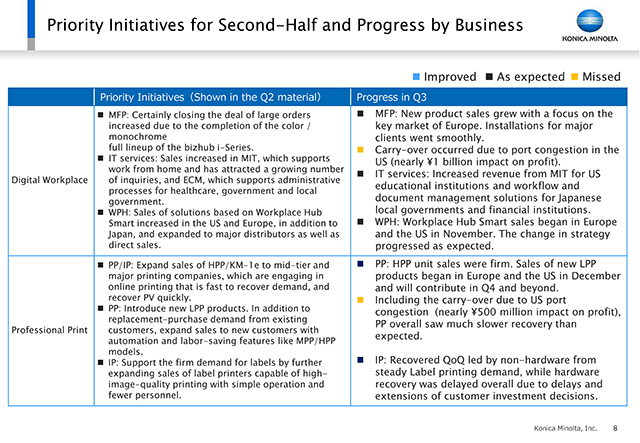

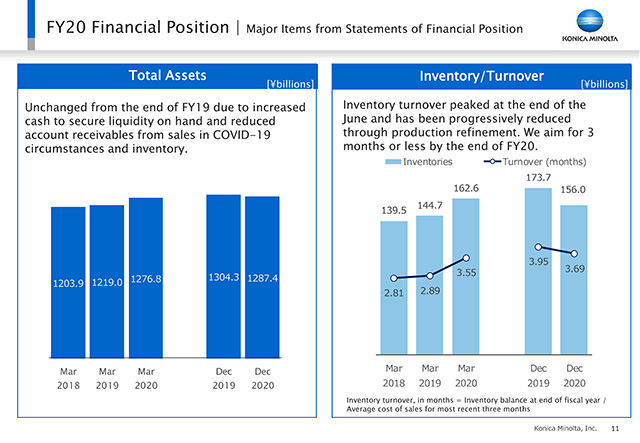

I would like to explain the progress of major initiative in the second half, which are explained at the briefing session of the Q2.

In Digital Workspace Business, we have completed the line-up of A3/A4 color and monochrome MFP as i-Series. The sales have been expanding since the Q2, with the acquisition and installation of large-volume projects proceeding smoothly, particularly in Europe, which is our key market. On the other hand, in the U.S., around ¥1 billion profit was carried over to the Q4 due to port congestion affected by the COVID-19.

Revenue of IT services increased, which was driven by growing demand of managed IT services for the educational institutions in the U.S., and workflow and document management solutions for Japanese local governments and financial institutions. Workplace Hub launched Workplace Hub Smart based on i-Series with Windows server in Europe and North America in November as planned. Revenue increased as the strategic changes described in IR Day progressed as expected.

In Professional Print Business, sales of AccurioPress C14000 series as heavy production print machine were firm, targeting medium-and large-sized printing companies that were engaged in printing mail-order sales etc., which was rapidly recovering in demand. In the light production print field, we began sales of new products AccurioPress C4080 series with automation and labor-saving functions similar to those of mid and heavy production print machines as planned. They will make a full-scale contribution to profit from the Q4.

The impact of port congestion in the U.S. has resulted in carry-over of around ¥0.5 billion profit to the Q4 in this business, too. In addition, we recognize that the recovery of this business as a whole has been delayed due to delays and extensions of customer investment decisions.

In industrial print, recovery of sales in hardware was delayed overall due to delays and extensions of customer investment decisions as in the case of production print. However, sales of label printer and other non-hard have been increasing, and overall sales of hardware and non-hard have continued to recover toward the FY19 level.

9/20

In Healthcare Business, in the field of modalities, we strengthened the partnerships with the X-ray manufacturer for dynamic digital radiography. In Ultrasound, we are expanding our lineup and strengthening sales in obstetrics areas, which is one of our strengths, by adding Canon products.

In precision medicine, the number of contracted facilities of CARE Program, which is genetic diagnosis services for healthy individuals, is steadily increasing, and the number of DNA tests, including CARE Program, is growing. In addition, CARE for COVID received a large order from Orange County, California, and the number of PCR testing are expanding. In drug discovery support services, projects remain on hold due to reduced numbers of clinical trial participants following the COVID-19 crisis. However, the amount of remaining order and backlog are further expanding, and we are working to harvest it as the situation normalizes in the future.

In Industry Business, orders for automobile visual inspection, which is positioned as a growing area in measurement instruments, are progressing, although there is a delay in negotiations due to the impact of the COVID-19. In addition, we executed the acquisition of Specim, a leading company of hyperspectral imaging that provides customer value as "safety, security, and hygiene" in the food, pharmaceutical, recycling, and other inspecting areas, to expand our business into the invisible sensing field. We will consolidate Specim in the Q4 and move forward to full-scale entry into the markets that are expected to grow over the medium to long term.

In performance materials, we are steadily expanding SANUQI film for large LCD TVs, and are promoting high-value-added film for small and medium-sized displays as planned.

In image-IoT solutions, we began offering our proprietary imaging-IoT platform “FORXAI,” and we have progressed in developing partner companies.

10/20

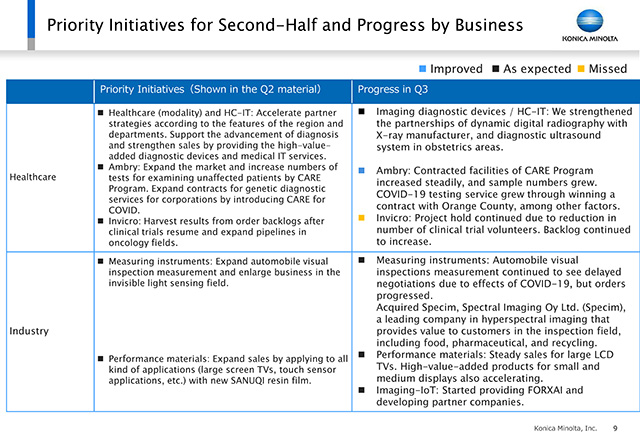

In this slide, I will explain the change points in each business with transition of KPIs on the quarterly basis.

In Digital Workspace Business, sales of non-hard recovered on the quarterly basis and reached 86% in the Q3. Unit sales of A3 MFP also recovered steadily, reaching 94% in the Q3. In the Q3. The recovery in non-hard was weak due to low attendance rate in Europe and the U.S., and the recovery in hardware was relatively strong, partly due to the impact of new products and the progress of large-scale projects. By region, office business continued to see the momentum of revenue increase in China, reached over 115% in the Q3, recovered to over 95% in Japan, 85% in Europe, and 80% in North America.

IT services were on the same level of sales in the Q2 YoY, and sales in the Q3 began to increase for the reasons I mentioned earlier.

In Professional Print Business, production print, unlike office business, has been recovering non-hard sales ahead of hardware sales, reaching 84% in the Q3 YoY. Unit sales of hardware have been slow to recover, at 67%. By region, sales in Europe were just under 80% and those in North America were 70%, both at the Q2 level. On the other hand, the trend of increase in sales expanded more than 130% in China, and recovering to just under 90% in Japan.

In industrial print, growth in non-hard continued in both Europe and the United States, reaching 130% in the Q3 YoY. We believe hardware will follow in the future.

In Healthcare Business, sales activities for hospitals and clinics resumed, and DR sales volume was robust at 106%. In genetic testing, saliva-based DNA testing at home contributed to the recovery of the number of genetic testing, although RNA testing, which require blood collection at hospitals, has recovered slowly. As a result, the number of tests recovered to the FY19 level in the Q3 following the Q2. In drug discovery support services, we continued to expand the backlog to 164% in YoY as I explained earlier.

In Industry Business, sales of measuring instruments for displays continued to be strong due to continuous demand from major customers and demand in Asia. In performance materials, demand for films for large TVs, laptops, and smartphones continued to increase as people have stayed at home. Sales increased both of QoQ and YoY basis.

11/20

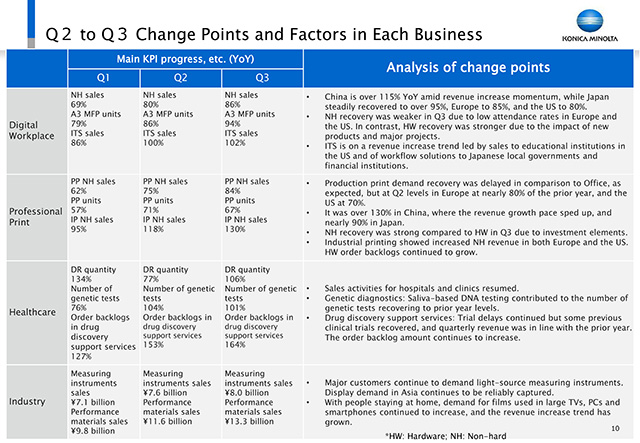

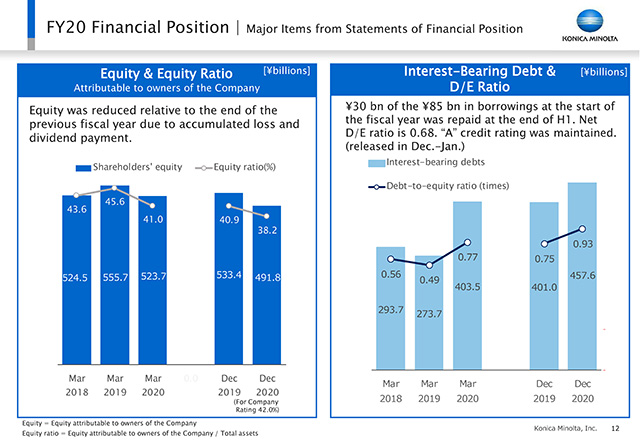

I will explain the financial position.

Total assets were unchanged from the end of FY19 due to increased cash to secure liquidity on hand, and reduced account receivables from sales in COVID-19 circumstances and inventory.

Inventory turnover peaked at the end of the June and has been progressively reduced through production refinement. We aim for 3 months or less by the end of FY20 and it has progressed as planned.

12/20

Although equity capital was reduced relative to the end of FY19 due to accumulated loss and dividend payment, we will increase it by recovering to be in the black in the Q3 as the starting point.

In interest-bearing debt, at the end of the H1, we repaid ¥30 bn of the ¥85 bn in borrowings for responding COVID-19 at the beginning of FY20. Net D/E ratio is 0.68. The latest credit rating has been maintained as “A” and there are no problems in our financial soundness.

13/20

Now, we will explain the priority initiatives in the remaining Q4, and earnings forecast in detail.

14/20

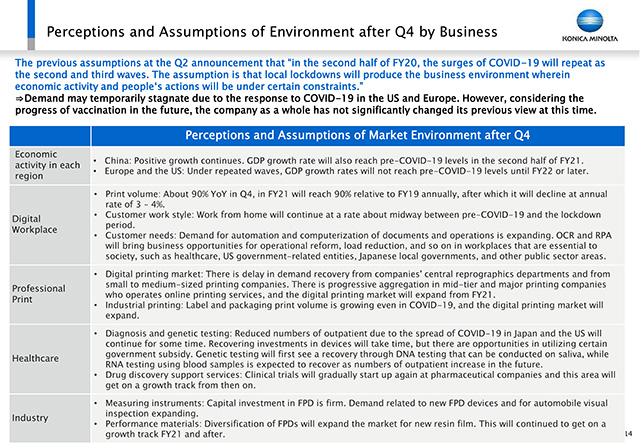

First, I will address perceptions and assumptions of the environment after the Q4 as the company overall and by business.

Considering the current situation of COVID-19 responses in the U.S. and Europe, demand may temporarily stagnate in some businesses. However, taking account of the progress of vaccination in the future, the company as a whole has not significantly changed its previous view at the 2Q.

For each business, I will explain mainly the items that has been updated from the 2Q.

In Professional Print Business, there is progressive aggregation in mid-tier and major printing companies who operates online printing services. Although the total printing market will decline from FY21, the digital printing market will expand in the circumstance. In Healthcare Business, reduced numbers of outpatient in Japan and the U.S. will continue for some time. Recovering investments in devices will take time, but there are opportunities in utilizing certain government subsidy. Genetic testing will first see a recovery through DNA testing that can be conducted on saliva, while RNA testing using blood samples is expected to recover as the number of outpatients increase in the future. As a result, the RNA testing will be added on top of the preceding DNA testing. In measuring instruments, although we expected the capital investment in FPD would be leveled off, but it remained firm. Demands related to new FPD devices along with LCD and OLED and automobile visual inspection are expected to be expanding. In performance materials, diversification of FPDs will expand the market for new resin film SANUQI.

15/20

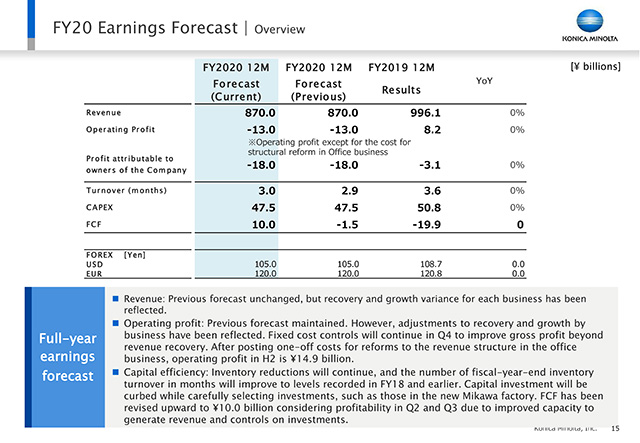

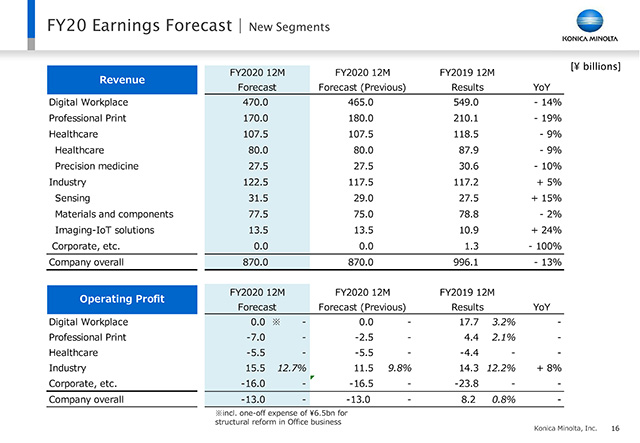

This is overview of earnings forecast.

As I explained at the beginning of the session, we don’t change our previous forecast of revenue and operating profit, but we have reflected strength and weakness in the forecasts of each business with progress up to the Q3 and some expectations in mind. Operating profit in the H2 will be ¥ 14.9 billion which will lead to a recovery in profitability from FY21 onward. As capital efficiency, we reduce inventory continuously, and the number of fiscal-year-end inventory turnover in months will improve to levels recorded in FY18 and earlier. Capital investment will be curbed while carefully selecting investments. Free cash flows have been revised upward to ¥10.0 billion for the fiscal year, which is the first surplus year since FY14 excluding the effects of sales and leaseback, considering profitability in the Q2 and the Q3 due to improved capacity to generate revenue and control on investments.

16/20

This slide shows the earnings forecast by each business.

Revenue and profit of Professional Print Business is revised downward considering the business condition. And revenue and profit of Industry Business is revised upward considering the business condition especially those of measurement instruments and performance materials.

17/20

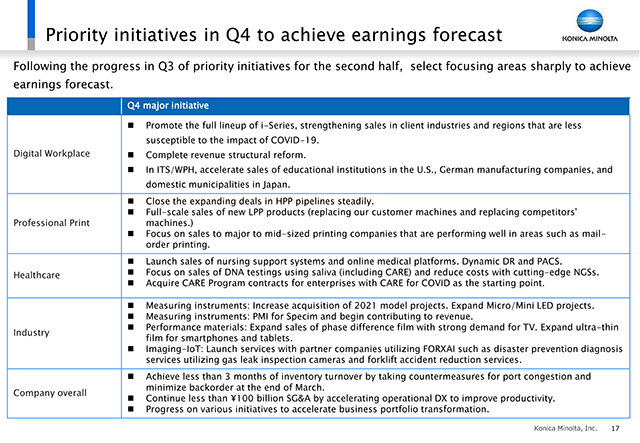

This section explains priority initiatives in the Q4 to achieve earnings forecast.

Let me start by talking about the Company overall points. Promising Industry Business will continue to grow with current strong momentum, and the recovery of Healthcare Business in the Q3 will continue to the Q4. Based on the tendency of growing sales and improved profit of ITS and Workplace Hub, we intend to expand mainly DX services by combining the digital and AI technologies featured in DX2022, and aggressively pursue the expansion that will lead our growth in the 4Q and beyond FY21.

In Digital Workplace Business, there are three major points. First, we promote the full lineup of i-Series, strengthening sales in client industries and regions that are less susceptible to the impact of COVID-19. In particular, we will aim to acquire large-scale projects for which we are progressing negotiations in the U.S. and Europe, and to acquire the projects at the end of the fiscal year in Japan and record sales of them. Second, we will maximize cost reductions, as I explained earlier. Third, we will accelerate ITS and Workplace Hub, which have increasing sales momentum in educational institutions in the U.S., German manufacturing companies, and municipalities in Japan, and definitely lead to profits. For structural reform, we have already begun concrete actions in some foreign countries. We are also shifting human resources to priority businesses from office business as planned.

Professional Print Business, which has been slow to recover, will maximize sales by closing the expanding deals in heavy production print pipelines steadily, full-scale sales of new light production print products, and focusing on sales to major to mid-sized printing companies.

In Healthcare Business, we respond to urgent social issues by launching sales of a nursing support system that incorporates our pulse oximeter, which was approved by the Ministry of Health, Labor and Welfare for application of rapid judgement in PMD Act in December, as well as our on-line medical treatment platform. In addition, we are strengthening sales of dynamic digital radiography that enable dynamic imaging in collaboration with Shimadzu, which has already adopted our DR. PACS has received an order from the second largest imaging center in the U.S., and we will leverage it to further expansion of sales in future subscription models. At genetic testing, we focus on DNA testing that can be tested with saliva sampling at home, including CARE Program, and reduce costs through the latest next-generation sequencer introduced in the H1. In addition, we will acquire CARE Program contracts for enterprises with CARE for COVID as the starting point.

Next I will mention Industry Business. In measuring instruments, we will increase acquisition of investment in 2021 model projects of customers and expanding projects related to next generation displays such as Mini LED and Micro LED, which are increasing at present. In addition, we will start integrating the acquired company, Specim, and contributing to earnings. and we move forward into a full-fledged entry of the hyperspectral imaging field. In performance materials, we will expand sales of phase difference film with strong demand for TVs, and ultra-thin film for smartphones and tablets. In imaging-IoT solutions, we will launch services utilizing FORXAI such as disaster prevention diagnosis services utilizing gas leak inspection cameras and forklift accident reduction services with partner companies, such as Mitsui Sumitomo Insurance, Aioi Nissay Dowa Insurance, and MS&AD Inter Risk Research & Consulting. We will increase the number of partners in the future and accelerate the expansion of FORXAI business.

As the company overall, in order to improve cash flows, we aim to achieve less than 3 months of inventory turnover at the fiscal year end, and we will minimize the fiscal-year-end order backlog after taking measures to deal with the impact of port congestion. We will continue less than ¥100 billion SG&A by accelerating operational DX to improve productivity by expanding non-face-to-face sales, installation, and services, and expanding the geographical deployment of scientific sales approaches.

For strengthening business portfolio management, as I explained in IR Day, we are advancing measures for each business that is positioned in each category of the portfolio. We intend to hold a briefing on the progress of precision medicine in the near future as the introduction of progress of one of the measures. In addition, we are already considering measures for low profitable businesses, and we will explain them at an appropriate time because there are some counter partners.

18/20

The dividend forecast remains unchanged from the Q2. We expect to pay the period-end dividend of ¥15 and the annual dividend of ¥25, considering we tackle to achieve profit levels in FY21 and FY22 with a high probability.

19/20

Here are some of our sustainability initiatives and our most recent external evaluations.

We disclosed Medium-Term Sustainability Strategy 2022 with the announcement of our Long-term Vision and Medium-term Business Strategy "DX2022" in November. At the same time, we renewed the sustainability report on the web. We started to disclose the progress of Eco Vision 2050, in which we would bring the attainment of Carbon Minus forward to 2030 from 2050 by utilizing DX and providing our environmental technologies and know-how to our customers, suppliers, and other partners. Also, we started the disclosure in accordance with SASB in addition to TCFD framework.

As external evaluations of these initiatives, we received our fourth selection for the third consecutive year of the "Global 100 Most Sustainable Corporations in the World in 2021" announced at Davos 2021. We were selected as only 5 Japanese companies and were ranked 41st, raised two years in a row. We were listed on the "Dow Jones Sustainability World Index" for the nine years consecutively, and given the highest evaluation by CDP and included on the "Climate A List 2020." Also, we received “2020 Minister of the Environment’s Award for Climate Action” this year. The reason for this award was high evaluation of our having launched “Environmental Digital Platform,” in which diverse companies can utilize the know-how we have accumulated through our environmental activities together with our suppliers utilizing DX as I mentioned earlier.

We plan to hold IR Day in early March to promote understanding of our initiatives related to intangible assets and non-financial matters as well as these sustainability initiatives. We would like analysts and investors participate in it and will provide detailed this information separately.

Based on today’s contents, I would like to mention the important points for the next term at the end of the session.

The first point is to promptly return the profitability of office business to the FY18 level of operating profit ratio 9% or higher. We have started to implement the initiatives already, and will have completed them until the end of FY20.

The second point is that each business, which is a pillar of future growth, has entered a trend of increasing sales and profits from this quarter. We will maintain this momentum in FY21.

The third point is our tackling with the portfolio transformation. Regarding precision medicine, we are in the process of concluding agreements with prominent global DX partners, and we will provide the information near future. We will hold a business briefing including update from the previous IR Day and the detailed information will be provided separately. We have begun to consider and respond to low-profit businesses, and we will be able to announce the specific actions during FY21.

By accelerating these actions, we will focus our efforts to achieve operating profit of ¥40 billion in FY21 and ¥55 billion in FY22 with a higher probability.

This is the end of my presentation. Thank you for your attention.

20/20

I will explain our financial results for the Q3, which we disclosed at 15:00.