|

|||

1/20

Allow me to explain the financial results for FY20 ended in March 21.

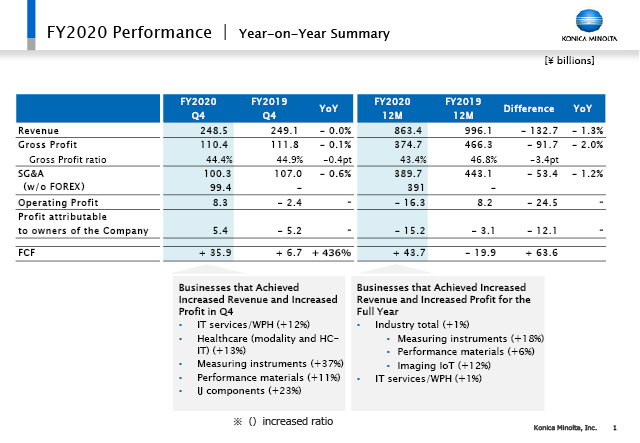

First, Revenue in Q4 was ¥248.5 billion, almost the same year on year. Gross profit was almost the same year on year.

As for SG&A, we made our further efforts to reduce it.

Operating profit in Q4 was ¥8.3 billion.

Profit attributable to owners of the Company was ¥5.4 billion.

I will give you details later, but businesses that achieved growth in revenue and profit in Q4 year on year were IT services including Workplace Hub, Healthcare (modality and HC-IT), measuring instruments, performance materials and IJ components.

The numbers in the parenthesis show the growth rare.

As for the full-year basis, revenue was down 13% year on year, ¥863.4 billion. This had a great impact, but as for SG&A, it was reduced by ¥53.4 billion since the last year, resulting in operating loss of ¥16.3 billion and profit attributable to owners of the Company was ¥15.2 billion.

In terms of the full year, we had growth both in revenue and profit in Industry total, measuring instruments, performance materials, imaging IoT as well as IT Services. Our print business is still faced with severe Covid-19 plight, but some of the businesses are already showing recovery to the level of pre-Covid-19.

2/20

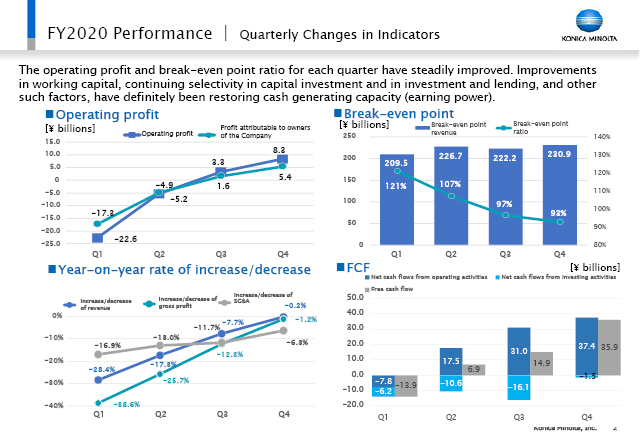

This shows quarterly changes.

Operating profit became profitable in H2.

The same goes to profit attributable to owners of the Company.

As for ¥8.3 billion of operating profit in Q4 is going to be ¥11.5 billion if we are to take out the structural reform cost of ¥3.2 billion, which we had toward the end of the fiscal year.

The bottom left graph shows year-on-year rates of increase or decrease.

As shown in here, revenue was almost in the recovery mode in Q4 year on year.

Please find the details by region on page 24, and please refer to them later.

Gross profit margin hit the bottom in May. We had big gap particularly in office and professional print due to the print volume impact. But with this recovery, the gross profit margin improved. With Industry Business becoming bigger, the gross profit margin gap was reduced.

SG&A has been constrained.

All in all, as shown in the break-even point in top right, its ratio became 93% in Q4. As for free cash flow, it grew from the positive ¥6.9 billion in Q2 to ¥14.9 billion in Q3 and further to ¥35.9 billion in Q4.

3/20

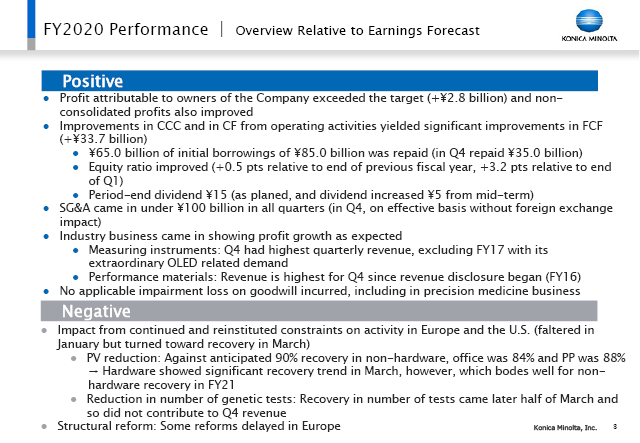

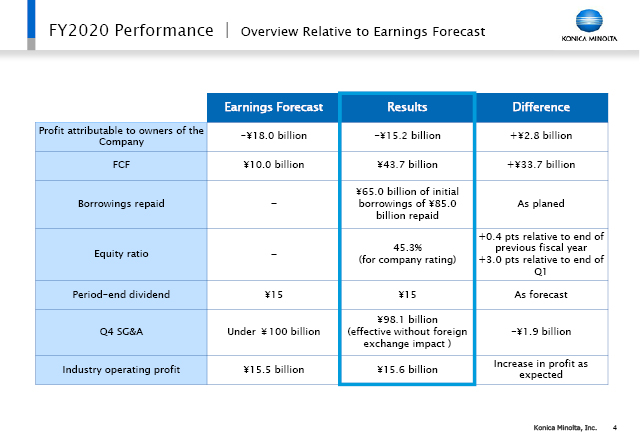

I would like to make a comparison between the actual results vis-a-vis the earnings forecast we made. We had both positive and negative aspects.

Positive side.

Profit attributable to owners of the Company exceeded the target by ¥2.8 billion. Non-consolidated profits also improved.

Earlier I touched upon free cash flow. It was up ¥33.7 billion over the forecast. This is mainly driven by operating cash flow.

We had the initial borrowings of ¥85 billion, but we paid back as much as ¥65 billion. With this done, equity ratio as of March-end was up 0.5 points compared with end of the previous fiscal year. In comparison to the end of Q1 when it was quite tough, it went up 3.2%.

As planned, we will pay period-end dividend ¥15, up ¥5 from the interim dividend.

We planned to have SG&A under ¥100 billion in all the quarters. Excluding the FX impact, it went under ¥100 billion in real terms in Q4.

Industry Business came in as we had expected. Measuring instruments had a record high for Q4 if we are to exclude in FY17 when we had a special demand for OLED.

Performance materials also had a record high in Q4 on the quarterly basis since we started its disclosure.

You may have a concern, but the company auditor has finished its evaluation of our business including precision medicine business, and told us there is no impairment loss on goodwill to be applied.

The negative side.

In terms of the forecast we made, we were particularly affected in January and February by the lockdown imposed again in Europe and the U.S. Though we had forecasted a 90% recovery in the non-hardware revenue, it turned out to be 84% in office, and 88% in production printing. This gap had its impact on operating profit.

The number of units of the sold hardware recovered in March. This will have a positive impact on the non-hardware business in FY21 onward.

Another point is the genetic tests being conducted by Ambry. The number of visits to hospitals in the U.S. in January and February declined. The recovery of number of tests started in the latter half of March. So, its contribution to revenue will take place in FY21.

As for the structural reform, its plan has been postponed partly due to the negotiation we had with labor unions in Europe.

4/20

This slide shows those points quantitatively.

I will not repeat the positive aspects, but profit attributable to owners of the Company was up ¥2.8 billion.

Next line shows free cash flow.

Borrowings were paid back.

Equity ratio for the company rating was 45.3%.

Dividend, SG&A are described. Operating profit derived from Industry Business was ¥15.6 billion.

We ended Q4 with those numbers.

5/20

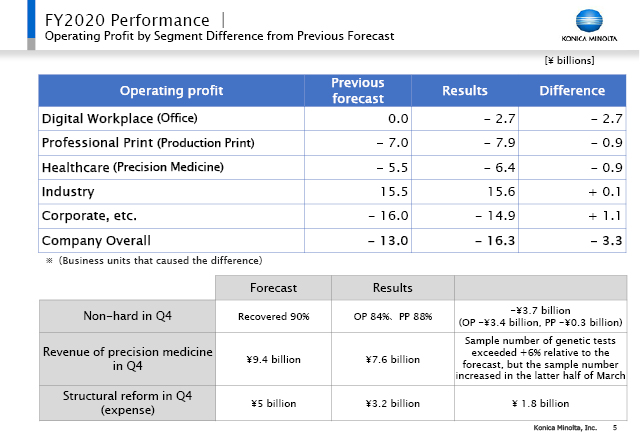

The negative points are reflected in this table.

Against the loss forecast of ¥13 billion for the entire company, we generated a gap of ¥3.3 billion.

The reason for this is shown here by segment.

Office had negative ¥2.7 billion, production print being negative ¥0.9 billion, precision medicine being negative ¥0.9 billion.

They are the reason for the gap of ¥3.3 billion.

In office, operating profit from non-hardware was down ¥3.4 billion. With the print volume reduction in production print, its impact on operating income was ¥300 million.

We had a delay in the additional structural reform plan. We forecast this to be ¥5 billion, but it turned out to be ¥3.2 billion. The gap here is ¥1.8 billion.

With the partial delay in Europe, this ¥1.8 billion in a sense helped us in terms of the cost incurred.

Out of this ¥1.8 billion, ¥1.5 billion goes to office and the rest to production print, so the gap of ¥2.7 billion for office will become ¥4.2 billion in real terms. Of which, ¥3.4 billion is non-hardware. ¥900 million for production print will become ¥1.2 billion in real terms, by adding ¥300 million.

Of which, printing volume is ¥300 million, and the remaining is hardware.

Precision medicine ended ¥7.6 billion in revenue due to the impacts in January and February. But the number of samples received for genetic tests recovered dramatically in March. It grew 6% in Q4 against the forecast in terms of the number of the samples.

6/20

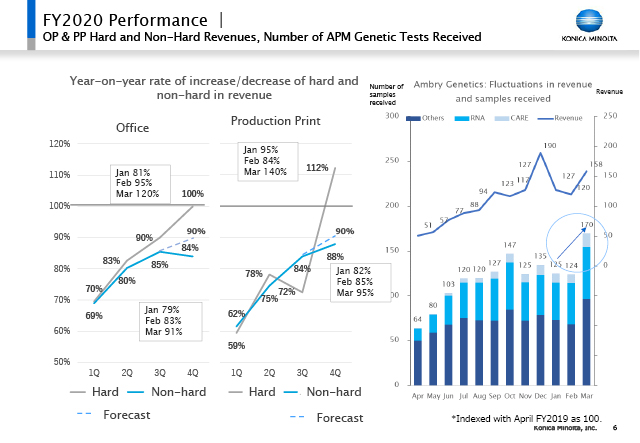

Now those numbers are plotted in these graphs.

The left graph shows office. The blue line is revenue from non-hardware.

At the end of Q3, non-hardware recovered 85% year on year. As shown in the dotted line, our original expectation was 90%. But it turned out to be 84%, down 1% because of the impact in January and February in the U.S. and Europe. In March, it recovered up to 91%.

In the meantime, the hardware in gray shows 100% in Q4. In March it was actually as high as 120%.

Moving on to production print, non-hardware revenue was 88% vis-a-vis the forecast of 90%. But it was 95% in March. As for hardware it was 112%, and in March it went up to 140%, showing a high recovery.

The number of genetic testing samples received by Ambry is shown here in the bar graph. It was rather slow in January and February. March shows a recovery, and this recovery is going to have its impact on performance in FY21.

7/20

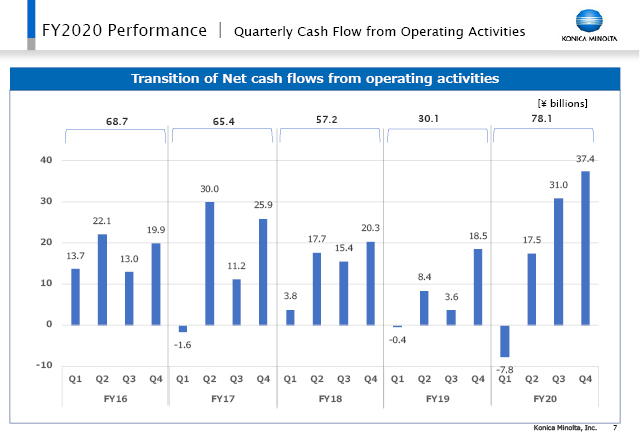

This graph shows operating cash flow.

It shows the changes over the past five years.

As shown here, the annual number is ¥78.1 billion. It is actually the highest in the 5-year period, and the total for H2 was ¥68.4 billion.

8/20

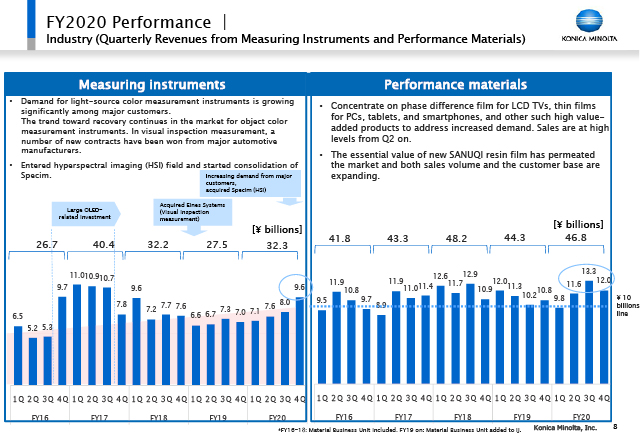

Let me look into the Industry Business. I would go through the quarterly revenues of the core businesses, namely measuring instruments and performance materials. These figures show the quarterly revenue for five years.

The left one shows measuring instruments. The latest Q4 shows ¥9.6 billion in revenue. This is rather comparable to the revenue back in FY17 when we had a special demand for OLED. But in the background, we acquired in 2019 Eines Systems for automotive visual inspection measurement. And furthermore, as recent as in Q4, we acquired Specim, giving us new domains such as food and pharmaceuticals. They are now getting into our consolidated results.

The right one shows performance materials. Starting from Q2 FY20, it grew firmly. For the full year, it became ¥46.8 billion. This business is now backed up by large displays as well as our strong capabilities such as thin films for both small and mid-sized and mobile displays. We are now promoting our new resign film called SANUQI, and its essential value is now getting appreciated.

9/20

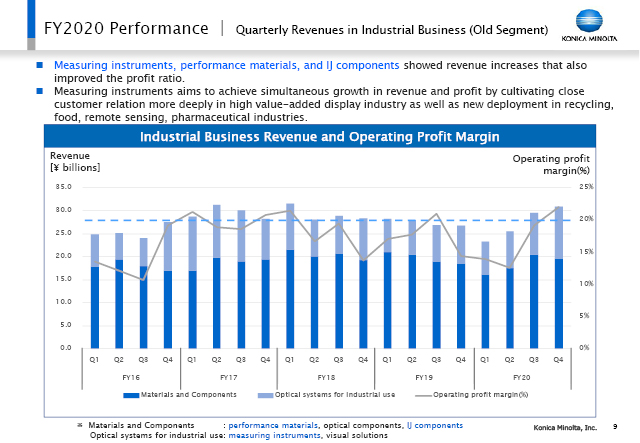

These two businesses are the core of Industrial Business, as the former segment. Its operating profit ratio is shown in the gray line.

From Q3 to Q4, it surpassed the 20% line.

Measuring instruments, performance materials with strong IJ components, whose number is not yet disclosed but it has a high profitability, showed revenue increases that also improved the profit ratio as a whole.

In the measuring instruments, we are currently reducing our dependency on displays, while accelerating our efforts in other areas such as recycling, food, remote sensing and pharmaceuticals.

This concludes the section of FY2020 performance.

10/20

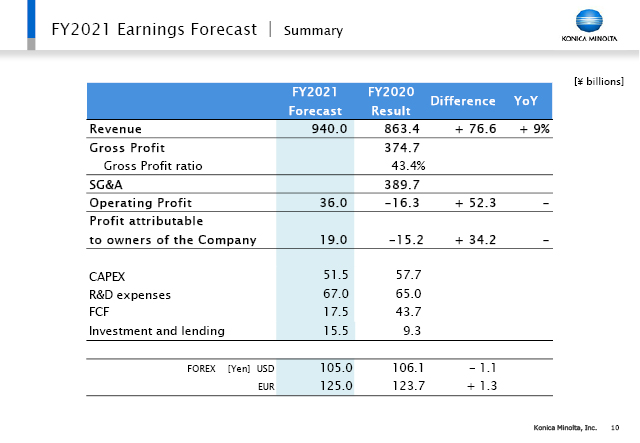

Now I would like to move on to our forecast for FY21.

Revenue is expected to be ¥940 billion, up 9% year on year.

Operating profit is ¥36 billion and profits attributable to owners of the Company is ¥19 billion.

Assumption for forex is ¥125 to a Euro.

I will go into details in the next slide.

11/20

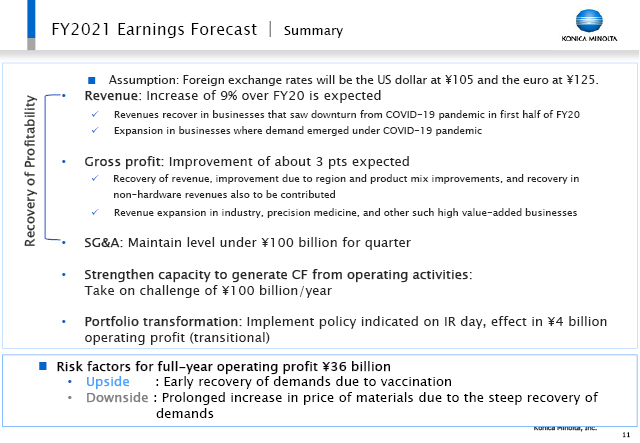

I have just touched upon the assumed foreign exchange rate.

Revenue increase of 9% is an expectation of recovery from H1 of FY20.

And we should be able to leverage our business opportunities coming from COVID-19 pandemic.

I would like to emphasize that we do believe there is going to be a good chance for us to improve around 3% in gross profit.

Recovery of revenue can be expected from the region and product mix improvements, as well as recovery in non-hardware.

Industry, more than 20% in operating margin, definitely has a higher gross profit.

Precision medicine has 60% plus gross profit ratio.

Therefore, if its sales go up, naturally its margin will go up.

However, right now with our strategy in place, we are now making advanced investment into SG&A, causing a tough situation against creating operating profit.

Precision medicine definitely makes a big contribution to gross profit.

SG&A continues to be ¥100 billion on the quarterly basis.

We will control this tightly.

And we will challenge to aim at ¥100 billion in operating cash flow for the full year.

The latest forecast of ¥36 billion does include the transformation of our portfolio, which we explained back in November last year on our IR Day.

To be specifically, there are the low profit businesses as shown in the capital policy quadrant. We intend to go for the change even by finding the best owners.

Another point is having to do with the new strategic business. As we have explained this back then, here we are looking at all possibilities for flexible funding. We should not postpone it. We are now working in the mid-term for 2 years, FY21 and FY22, but we would like to go about it as soon as possible to transform our portfolio. It will hit us as much as ¥4 billion yen as cost, but it is one-time in nature. I would like to remind you again ¥36 billion does include them.

Now risk factors against this outlook.

As for the upside, our FX assumption is ¥125, so we will have foreign exchange contract. Due to the fact that Konica Minolta has higher portion of business in the U.S. and Europe, the quicker recovery of the demand thanks to the Covid-19 vaccination effect is definitely going to be upside for us.

As for the downside, though we had already taken it into account to some extent, with a rapid economic recovery, it may have an impact on prolonged increase in materials price. This is going to be a risk factor against us.

And this may prolong into H2 as a possible downside.

12/20

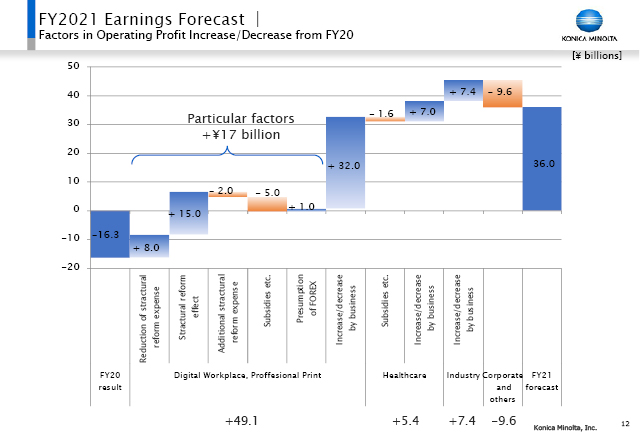

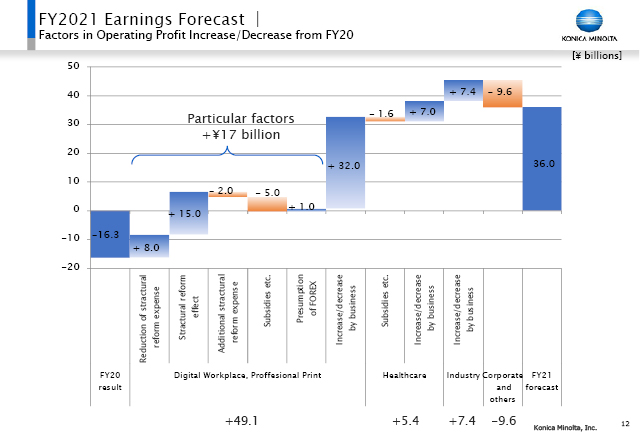

This shows the factor analysis for ¥36 billion of operating profit in FY21 from FY2O.

Briefly, in Digital Workplace and Professional Print, other particular factors account for plus ¥17 billion. Here we are looking at both the effect and dropping of the cost having to do with the structural reform. Also, the subsidies received globally will naturally become a minus factor.

Digital Workplace and Professional Print show positive ¥32 billion by business. With including these factors, the businesses become plus ¥49.1 billion as described in the bottom.

Healthcare, positive ¥5.4 billion, Industry, positive ¥7.4 billion, Corporate and others being minus ¥9.6 billion. It means the cost will increase by ¥9.6 billion. Of which, ¥4 billion is the one-time expense for the sake of the portfolio transformation.

There is another factor behind this increase. We are looking into future, and we are now increasing strategic R&D activities as corporate R&D.

13/20

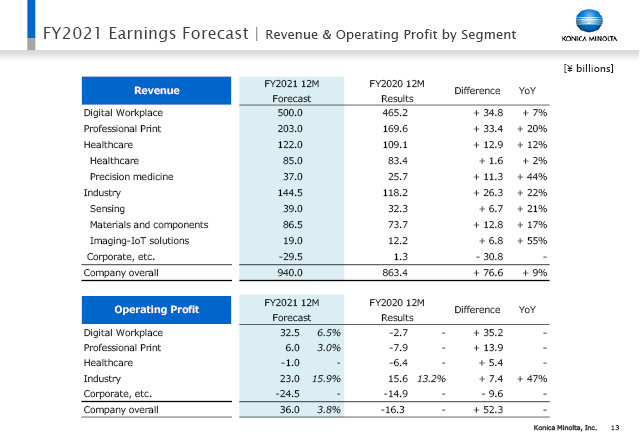

And this slide shows revenue & operating profit by segment. It shows increase and decrease.

14/20

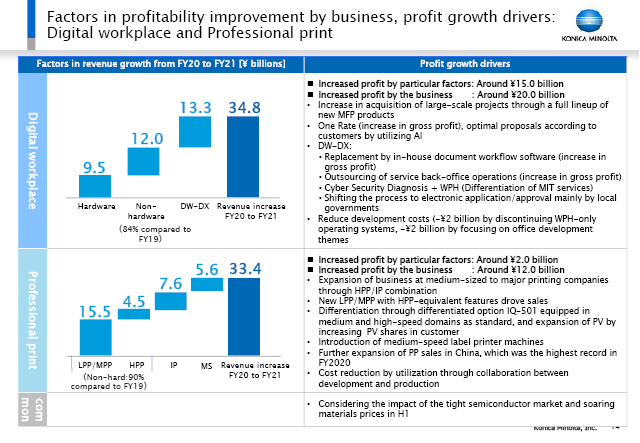

Allow me to be specific here by segment. First, Digital Workplace with office print as the core business. The left explains how we intend to create its revenue.

As for non-hardware, which was a major point in FY20, is now forecasted to be 84% compared to FY19.

In other words, the result of 84% in Q4 FY20 is now the number for the full year for FY21.

Here we are having a somewhat severe forecast.

As for revenue growth, besides the particular factor of ¥15 billion, we will increase the profit of ¥20 billion by the business. The specific measures are shown here. With the full line-up completed, we should aim at larger opportunities. Another being what we call One Rate, which is based on monthly charge other than based on print volume. We are now expanding this One-Rate contract by increasing number of overseas countries.

This is a business model to increase our gross profit. We are now utilizing Artificial Intelligence to recommend customer specific optimal proposal, and we are now pushing this actively.

DW-DX is regarding IT Services and Workplace Hub.

We intend to increase our own proprietary software development in order to increase our profit.

We also intend to outsource back-office operations in order to increase profit in IT Services.

And the hot topic now is cyber security. We plan to utilize Workplace Hub to diagnose cyber security and embed it into our Managed IT. We aim to become NO. 1 in this genre.

Now we are promoting electronic application and approval initiatives in Japanese local governments. We intend to make this process as our IT core service.

In this domain, the total development cost is reduced to ¥4 billion.

They are the factors to push up the profit.

Regarding Professional Print, particular factors are ¥2 billion, regarding factors by the business being ¥12 billion. Besides, the result of non-hard was 88% in Q4 FY20, we are assuming that the full-year recovery would be 90%.

As for the measures, we intend to expand our business to mid and large sized printing companies with our high-end production printing (HPP) and industrial print.

Furthermore, our new products will have features which are equal to high end products. This is giving us more competitive edge.

The main measure is that we make IQ-501, which is our biggest differentiation, as a standard. Another measure is we will launch new products in the label printing in high to mid speed area where we are quite strong.

We are now having a record-high sales of PP in China. We will keep it on this way, as well as we will reduce the cost.

However on the full-year basis, we are taking into account the impact from the semiconductor tight market and soaring materials prices particularly in H1.

15/20

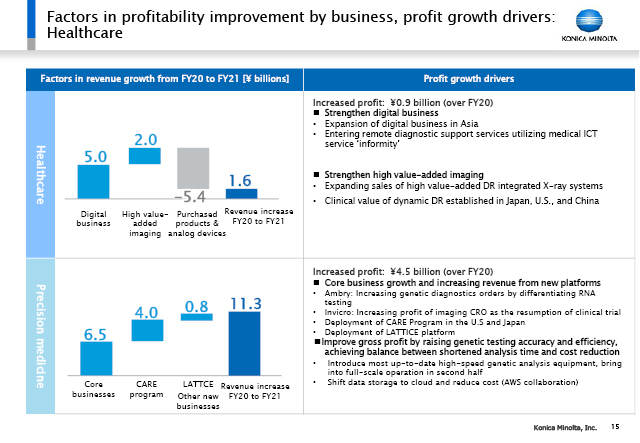

As for Healthcare, we focus on digitalization for profit growth. In terms of regions, Asia is quite critical.

Here in Japan, we will start remote diagnostic support services on our platform called informity, which we have already deployed in 10,000 plus facilities.

We have high-value offerings, DR integrated X-ray systems and dynamic digital radiography, where our technology has strength. We are now actively deploying clinical tests in Japan, the U.S. and China.

Regarding precision medicine, the number of RNA testing, as a core business of Ambry, is now increasing and has become our differentiating factor.

Regarding Invicro, in FY20, the number of clinical trials did not grow due to the reduction of participant in the trials. But the expected resumption is going to have a major impact.

We also plan to deploy CARE Program for the healthy people both in the U.S. and Japan.

IoT platform LATTICE, as we announced several months ago, will also make its contribution.

On the side of cost reduction, we will make sure to implement those points described here. The focus is placed on the top-line, but at the same time, we will reduce cost if necessary.

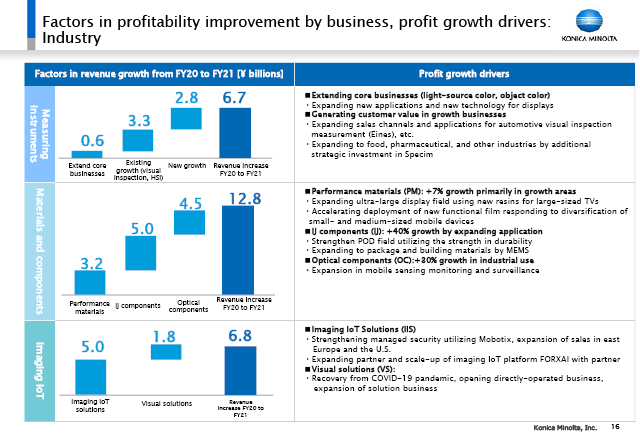

16/20

The next slide explains Industry.

As for measuring instruments, we apply our core business to new technologies of display. We need to surely launch this area and establish our presence here. But at the same time, we need to work on non-display areas, in order to expand our domain such as automotive, food and pharmaceuticals.

Performance materials in materials and components, we are now working on increasing market share of large-sized TVs.

We are now accelerating to deploy small/medium sized thin films.

As for IJ components, we are expecting to grow its revenue as much as 40%. We aim to strengthen the POD field with our strength in high durability competition. We also have strengthened our MEMS technology. We plan to further expand our business opportunities in package and building materials.

As for optical components, please refer to the points described here.

Imaging IoT is another growth driver on the mid-term basis. We plan to expand our sales in the East European and the North American markets in the form of managed security solutions with Mobotix system.

We plan to expand our partners and scale up the IoT platform FORXAI in FY21.

17/20

In regard to our forecast for FY21 earnings, allow me to add extra comments with going back to this slide. I told you back in the November IR Day that we would aim at ¥40 billion in operating profit as the management target.

The gap between previous ¥40 billion and current ¥36 billion has also been alleviated by the FX impact of about ¥4 billion mainly on the side of Euro.

But as I have just touched upon this earlier, we are now having severe estimation for print volume in office print and production print.

With the semiconductor and other factors taken into account, the FX benefit of ¥4 billion will be offset by these factors of ¥4 billion.

And on top of that, we are now working on the changes in the portfolio.

Back in November, we did not announce the cost. We will not postpone the portfolio transformation, and the estimated cost is ¥4 billion. With this subtracted, the final number is going to be ¥36 billion.

That’s all for FY21.

18/20

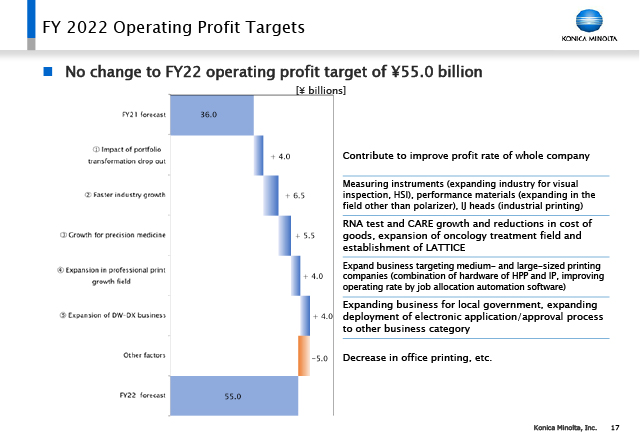

As for FY22, there is no change today comparing to the announcement on the IR Day, the target of operating profit is ¥55 billion.

Though I will not go into details, we intend to go for the profit in those areas for the sake of improved profit. We are now making our best efforts in order to increase its probability not only for FY21, but for FY22 as well.

19/20

This is my last slide. Konica Minolta is now transforming its portfolio.

There are 2 major changes we have in mind.

The first point is previous Office Business as our core business. We will deliver our unique Digital Workplace suited to the customer, which is not the ordinary IT service as others provide. It is our first transformation.

The second point is that we plan to reduce our dependency on office print in Digital Workplace as a whole. We would like to build another important business pillar following office print business. And we would like to complete the transformation in FY25. With this in mind, we would like to accelerate our strategic shifting including personnel and R&D expenses in FY21 and FY22.

In parallel, we will tighten operating cash flow if it is needed.

We will control SG&A at ¥100 billion, so that we can truly build our profit structure.

Lastly in regard to shareholder return, we improved our cash generating capability in FY20.

While keeping an eye on possible profit improvement up to FY22 with its probability taking into account, we forecast the annual dividend for FY21 to be ¥30 per share, up ¥5 from FY20.

I would like to conclude my explanation.

20/20