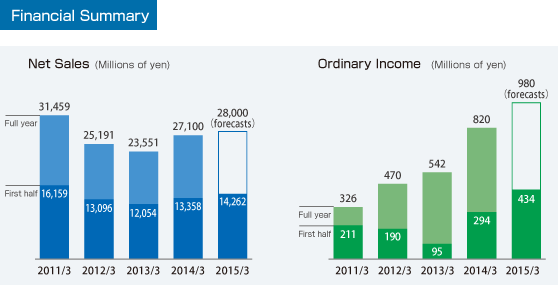

In the first half (H1) of FY2014 (April 1 to September 30, 2014), net sales for Advanex Japan rose 6.8% against the same period of the previous fiscal year (YoY) to ¥14,262 million; operating income climbed 48.3% YoY to ¥502 million; and ordinary income surged 47.3% to ¥434 million. Net income rose 19.4% YoY to ¥318 million due to an increase in tax costs as well as increased minority interests in subsidiaries resulted from a transfer of subsidiary shares. Net sales of products for automobile use expanded in China and Asia, while net sales of products for use in medical equipment in the United Kingdom were solid.

In Japan, net sales were on a firm footing, but the hike in the consumption tax blunted demand, sending orders received in H1 below our forecast at the start of the fiscal year. Growth is forecast to be moderate in H2. Going forward, we foresee growth in sales of insert collars, a core product, as one of the ramifications of our acquisition of Funabashi Electric Co., Ltd., and we are actively deploying products in this field.

Overseas sales have grown smartly over the past two years, in part because of the depreciation of the Japanese yen. Operations are especially robust in the United Kingdom and at our Dongguan Plant in southern China.

However, some regions have seen a drop in their plan fulfillment rate because some of our major customers in Japan are facing intense competition overseas. Attracting new projects will be an issue of vital importance in H2.

The automotive sector is on course to rise as a proportion of our net sales this fiscal year, from 36.9% in the previous fiscal year to about 40% this fiscal year. A lot of projects are coming to the fore now in insert collars, as well as in Funabashi Electric's deep-drawing technology. Many of the new projects coming on stream in H2 are related to auto parts. The launch our new auto-parts plant is sure to heighten our profile as an auto-part manufacturer, driving increased sales going forward.

Our aim with the new plant is to create a gsmart planth that automates production as much as possible, using just a small crew of employees. Wefve spent a lot of time fine-tuning the flow lines to maximize the efficiency of the production lines. For that reason construction will start three months later than planned, in October 2015.

Obviously the automobile market is our core market. Wefre also getting positive feedback from residential construction and infrastructure. In the former, condominium starts are driving demand for curtain rails, window sashes and the like, so we will be promoting sales of our Tamont nut locks. In some cases we will pursue joint patents with customers. In infrastructure, a railway company conducted endurance tests comparing the Tamont to competitorsf products, rating the Tamont exceptionally highly. This means that Advanex products may be used in to reinforce rails. If we can obtain such business results in the infrastructure space, the market for the Tamont series will broaden substantially. We then plan to develop operations beyond Japan, catering to railways in Europe, North America and China.

There was a lot of waste in the system at Changzhou Plant, which caused it to operate at a slight loss, but we've finally brought it up to profitable operation. We stationed one of our directors at the plant, from February to the end of June, and he succeeded in getting the facility to run smoothly. With Changzhou Plant stabilized, we are turning next to advancing our operations in India. The Indian market is currently propelling growth at our Singapore subsidiary, so we expect India to be a formidable growth center for Advanex.

We've held three of these conferences so far. Each time 12 people, the top people in our sales and manufacturing segments, meet at one of our locations. In the past, however, constructive dialogue has been somewhat lacking.

To improve the situation, we added senior people from operations. We introduced the two opposite perspectives of "overseas operations as seen from head office" and "head office as seen from local operations," then selected themes that deliberately adopted a third-party perspective for examination and discussion. We succeeded in having everybody understand the gap between the desired or target state of operations and actual conditions, and got everyone thinking about specific measures to bridge that gap. The participating members rated the exercise highly-I think it was a wonderful conference. To leverage the strengths of the Group to maximum advantage, I think it's important that we face each other directly and improve communication, sharing good news as well as bad.

I donft think any component in the world is as challenging as springs. Unlike most metal parts, springs have motion. Because they move as if they were living things, springs canft simply be produced in a die, ready to go. Their range of movement has to be tuned on a microscopic level according to the application. Knowing what kind of dies to produce them with and what degree to adjust them is extremely challenging. But the difficulty and the technical skill required are what make the sense of accomplishment so satisfying.

I always talk about the theme of gAdvanex Perfection: Pursuit of excellence in the production.h This pursuit is based on two indispensable factors: the good-product rate and strict compliance with delivery requirements. Advanex keeps its customers satisfied by consistently delivering products of excellent quality. For example, we have one customer whose basic policy is to purchase from two companies, but if you look at what the people on the shop floor use, they use Advanex springs exclusively. This tells us that the customer is continuing to use Advanex products without comparing them to our competitorsf. In addition to this example, Advanex has now gone one full year without producing even a single defective product. This is an accomplishment that we as manufacturers can take enormous pride in. I believe this result is a concrete manifestation of our philosophy of gAdvanex Perfection: Pursuit of excellence in the production.h