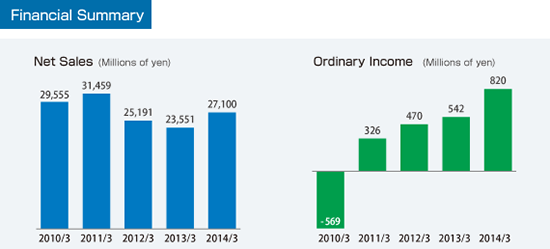

@Net sales rose 15.1% compared with the previous fiscal year (FY2013: fiscal year ended March 31, 2013) to ¥27,100 million, and operating income almost doubled, rising 92.1% over the previous fiscal year to ¥820 million. Ordinary income jumped 51.3%, also to ¥820 million, and net income grew 42.8% to ¥682 million. Our business results recovered nicely, thanks to growth in sales for automotive applications in Japan and overseas, as well as the effects of cost-cutting.

With the Japanese yen on a weakening trend, we are seeing some of our customers bringing production back to Japan. Also, we have been conducting area sales efforts focused on the auto market, with the result that many customers have established new accounts with us. Inquiries for projects in Japan are also on the rise, and we expect those to lead to increased sales. The weakening yen has had an impact overseas as well, and on that front I don't think our sales efforts have been adequate. This means that one issue we'll need to address in the current period is the formation of a global sales strategy. In particular, given the political instability in countries such as China and Thailand, we are training our sights on other countries in Southeast Asia, such as Vietnam, so that we don't miss any business opportunities.

This is a year in which our customers and we have some concerns regarding our directions in China and Thailand. There are ambiguous signs of a shift to Vietnam, Indonesia and the Philippines, as well as gonshoringh back to Japan. Taking stock of this environment, Advanex established a Global Business Unit in April 2014, as we aim to strengthen our Asia ex-Japan strategy still further. That Unit includes a China Business Promotion Office and a Southeast Asian Business Promotion Office, each of which is run by a general manager with extensive working experience in the region in question.

Beyond Asia, there is much to be positive about. In Europe, the recovery in the United Kingdom is proceeding smoothly, and sales in the medical field are growing across the region. Products for the medical market are taking up an expanding amount of space at our UK plant. We plan to draw on the expertise we have acquired there and deploy it in Japan and the rest of Asia, to capture further growth in this field. In Latin America, we are setting our sights on Mexico and Brazil, where we are hearing calls from customers related to the auto industry to set up a presence in their countries.

I've asked our directors responsible for Europe and the Americas to draft operating strategies for their respective regions.

In Precision Springs business, we have purchased Funabashi Electronics Co., Ltd., a company with superlative processing technologies in deep drawing, as well as in wire springs and flat springs. (Note: Please see Topics.) With this acquisition we have effectively covered the processing field, so we can now approach our customers as a comprehensive metals manufacturer and say, gWe can produce whatever metal parts you need.h Also, we are reinforcing our business in standardized products, so we can attract new customers through trading companies and online sales. We plan to use these efforts to capture orders for made-to-order products.

Plastics comprise another pillar of our operations, and sales to the automotive market are mounting in this field. In automobiles, we are enthusiastic about making capital investments and expanding our plant space in Vietnam. Vietnam is a dynamic market, so in addition to expanding our equipment roster we will be implementing robust quality and production management, aiming to grow our order book. Our medium-term target is to reach net sales of ¥50 billion and operating income of ¥5 billion in five years.

Parts sales to the auto industry are growing both in Japan and abroad, thanks to the depreciation in the yen. We're also receiving a considerable boost from the advancing trend toward lightweight construction and adoption of electronics in automobiles. In tandem with these factors, we need to implement plant management that's optimized for automobiles. To that end, here in Japan we're planning to build a dedicated auto-parts plant in the North Kanto area. Our aim is to become a gsmart companyh that is close to its customers' plants and has a high degree of machinery automation. We expect to have candidate locations selected by the summer and to complete construction during the fiscal year. We're going to act according to this fiscal year's slogan, gDouble speed.h

We believe no other company in the world can even approach Funabashi Electronics' technology in super-deep-drawing of fine materials in metal pressing. But the company has an aging workforce, and we were concerned that a world-leading Japanese technology might be lost if we didn't step in. Against this background, we perceived that there is a great deal of agreement between our two companies in terms of corporate culture, ways of doing things and managerial approaches, so we said, and gLet's work together!h So we inherited Funabashi Electronics' world-beating technologies. By combining those technologies with Advanex's business expertise, global reach and material-purchasing capabilities, we expect to increase our sales. The synergies are excellent.

The phrase originates from a conversation I had back in my days as head of the Production & Engineering Division. I was talking to a local engineer in China who judged performance solely on how well the quality of the finished product matched the plan drawings. But whether the product matches the plan drawings or not isn't the point. The point is to create a product that satisfies the customer and is easy to use. That's how a product becomes beautiful; functional beauty makes it the gbeautiful producth I aim for. Compared with five years ago, the word gbeautifulh comes up much more often in my conversations with employees and the reports I receive from senior management. I'm convinced that the message is getting through.

To achieve our medium-term targets, we are striving to improve business results and secure stable earnings. I believe our responsibility as managers is to return earnings resolutely to shareholders, while balancing this duty with the need to build up sufficient internal reserves to stabilize and expand our operating base. In the previous fiscal year we increased the dividend to ¥2 per share, against the forecast of ¥1.5 per share at the start of the fiscal year, thanks to a recovery in business results. We continue to ask for shareholders' guidance and encouragement as we pursue these objectives.

As part of our business strategy for standardized products, we are pressing forward with moves to attract new customers. Our aim is to create an e-commerce site like no other. When customers access the website, they will be able to find all of our spring products, including some that can only be purchased on the site. We plan to gradually enhance the portal site for standardized products. When customers search for the term "bane (spring)", they will be immediately directed to our site. We hope that the next step will be to generate interest in the special-order products derived from those standardized products, and ultimately to create a regular customer.